Houston maintains its top 3 position on ranking of cities that best attract biz

by the numbers

According to a recent report, Houston is still one of the top city in the United States for attracting new companies.

The ranking, which was researched and published by Site Selection Magazine, found that the Houston-The Woodlands-Sugar Land region attracted 255 business projects last year. This put the metro in the third place of the list that analyzed larger regions.

It's the third year in third place for Houston, and the city had a year over year improvement in number of deals; 2021 reported 213 new business projects in Houston. In fact, the top three cities – Chicago, Dallas, and Houston, respectively — has remained the same for all three years. For 2022, the Chicago metro garnered 448 projects, while Dallas-Fort Worth-Arlington reportedly had 426 projects.

The report also called out a recent statistic from Kastle Systems, which was based on building access control data. The stat found that among 10 major cities analyzed based on t week of February, Houston was one of three metros that had a returned-worker percentages higher than 50 percent.

According to the Greater Houston Partnership data, new business accounted for more than 50 percent of business announcements in 2022. GHP's data varied from Site Selection's due to a difference in reporting methods, but the organization's research identified 199 new business announcements in the Houston area in 2022.

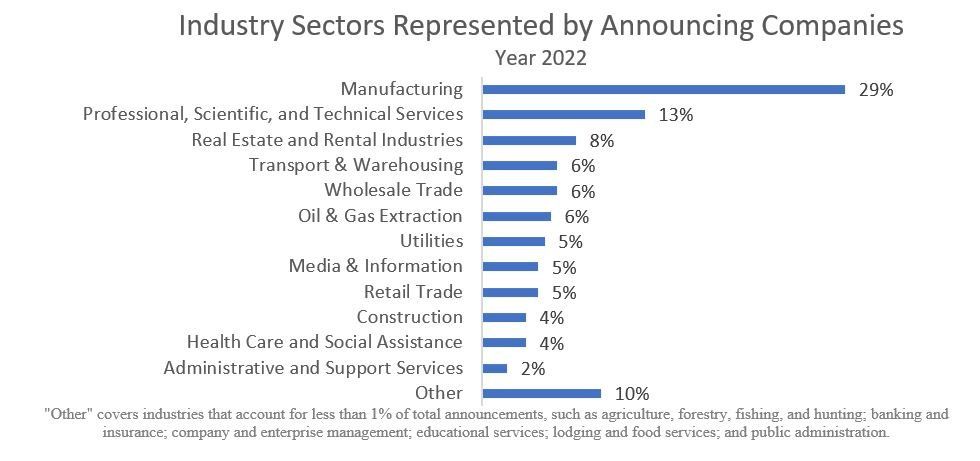

The NBAs included new businesses, HQ announcements, and expansions. The GHP data included information about these deals' industry verticals — and the manufacturing sector accounted for almost a third of the total NBAs in 2022.

The GHP also rounded up a few of the most prominate deals reported in their data. According to the Partnership, here were more details about these NBAs:

- Orsted — an offshore wind developer from Denmark is expanding its presence in Texas by establishing a new office in the Woodlands. The move is expected to create up to 100 jobs in the region.

- Syzygy Plasmonics — a Houston-based energy 2.0 company is expanding its operations to Pearland. The new location will serve as HQ, R&D, and manufacturing for its deep-decarbonization platform, creating up to 120 jobs.

- Alfred Talke Logistic Services — a German logistics firm is establishing a new facility in the region, serving as its U.S. headquarters. This project represents a $25 million investment and will create 240 jobs.

Trevor Best, co-founder and CEO of Syzygy, first discussed the company's expansion last year on the Houston Innovators Podcast.

"What we're seeing is the market's appetite for our kind of technology — deep tech for decarbonization in energy and chemicals — is really high. If we want to meet global demand for our product, we need to get ready to scale," he says on the show.