Amid international VC decline, here's what Houston startups received investment, grant funding last quarter

seeing green

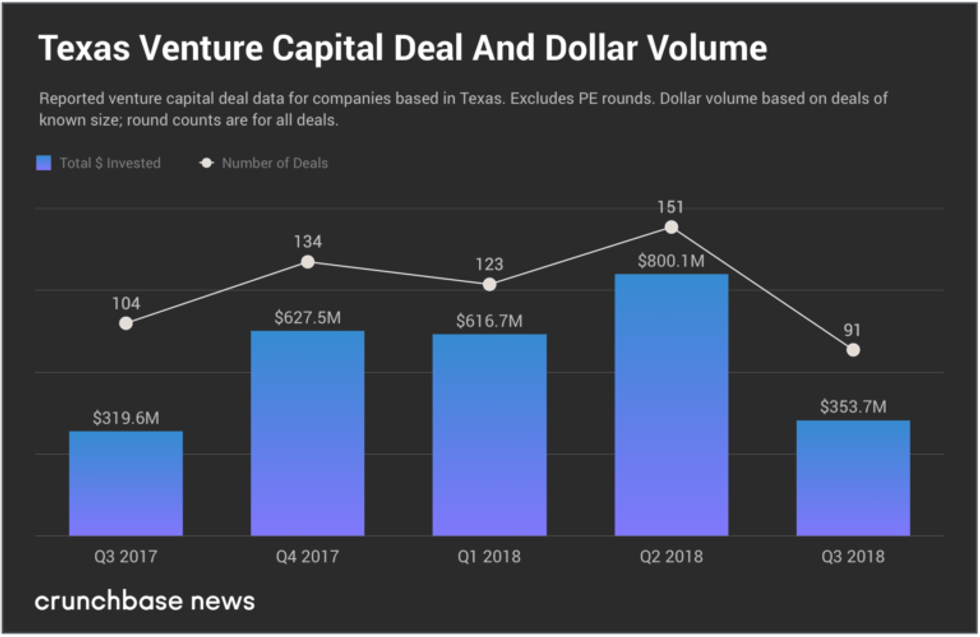

The second quarter of 2023 looked a lot like the first when it came to venture capital funding for Houston companies. The whole country — affected by inflation, geopolitical instability, and other factors — has seen a trying time for investment opportunities.

Houston's performance is far from unique. Globally, VC funding is down — a reported 18 percent from Q1 to Q2, per Crunchbase. Year over year, that's a 49 percent decrease from 2022's Q2.

According to InnovationMap reporting, 10 Houston-based, Houston-founded, or soon-to-be Houston-headquartered companies announced VC or grant funding between April and June. Here's a roundup of these second quarter deals — click on each story to read more.

Houston-founded e-commerce unicorn Cart.com raises $60M series C

Cart.com has secured its unicorn status at a $1.2B valuation with latest round of venture capital funding. Image via Cart.com

A Houston-founded software company — officially a unicorn company, valued at $1 billion or more — has announced the details of its latest fundraise.

Cart.com, which provides a suite of software solutions for commerce and logistics enablement, closed its $60 million series C equity funding round with a $1.2 billion valuation. Investors in the round included B. Riley Venture Capital, Kingfisher Investment Advisors, Snowflake Ventures, Prosperity7 Ventures, Legacy Knight, and more.

According to a news announcement from the company, Cart.com will use the funding for international expansion, continued product development, and to meet increased client demand. Continue reading.

Houston e-commerce company P97 Networks raises another $40M round to support growth

P97 Networks has again raised $40 million to support its growth. Photo via Getty Images

For the second time in just over a year, a Houston business that provides mobile commerce and digital marketing to the mobility and fuel industries has raised $40 million.

P97 Networks, which has developed a cloud-based mobile commerce platform that helps brands securely do business with customers, announced that it has closed its series C round at $40 million. The equity financing round was led by Portage and included participation from existing investors. The fresh funding will go to support growth strategy.

"In this highly connected world, retail brands are looking for new ways to increase consumer engagement — the power of network effects in the digital world will be a key contributor to revenue growth and margins," says Donald Frieden, CEO of P97 Networks, in a news release. "With consumers of all ages further adopting mobile payment solutions, we are proud to have built the leading connected commerce and digital marketing platform for the convenience retail, energy marketing, and transportation industry." Continue reading.

Podcast: Houston home tech startup SmartAC.com raises $22M to grow sales

Josh Teekell, founder and CEO of SmartAC.com, joins the Houston Innovators Podcast to discuss the latest from his company, which just closed its series B. Photo courtesy

A Houston startup that combines unique sensor technology with software analysis has raised its next round of funding to — according to Founder and CEO Josh Teekell — turbocharge its sales.

SmartAC.com launched in 2020, emerging from stealth with $10 million raised in a series A. Over the past almost three years, the company has firmed up its hardware, developed its software, and pivoted slightly from selling directly to consumers to adopting a B2B approach.

Now, Teekell says he's focused on turbocharging sales to these contractors, and he's going to do that with the funding raised in the series B round that closed this month. He says the company will also grow its team that goes out to deploy the technology and train the contractors on the platform.

"This funding really buys us a couple years of runway through the end of next year and allows us to focus on getting to cash flow breakeven, which is right around our wheelhouse of our abilities here in the next 12 months," Teekell says. "In general, we've accomplished everything we'd be able to accomplish on the hardware side, and now it's just about deployment."

The $22 million SmartAC.com has raised came from local investors. Teekell, who hasn't announced the full list of the round's investors, explains that while traditionally startups might have more opportunity on the coasts for raising money, it's not hard to sell Houstonians on the benefits of SmartAC.com's optimized air conditioning. Continue reading.

Houston fintech startup Brassica raises $8M seed round led by Mercury

A Houston fintech startup is aiming to modernize banking and investing — and has received fresh funding to do it. Photo via Getty Images

A Houston startup has raised millions for its fintech platform — and the company didn't have to go very far to find its lead investor.

Brassica Technologies Inc. closed its seed round at $8 million with Houston-based Mercury Fund leading the round. Valor Equity Partners, Long Journey Ventures, NGC Fund, Neowiz, Broadhaven Ventures, Armyn Capital, VC3DAO, Alpha Asset Management (Korea), and other global FinTech investors participated in the round as well.

The startup's platform has "institutional-grade solutions for the new era of private investing and alternative assets," per the release. Serving the alternative assets industry, Brassica's tools can easily integrate with any operating system to provide proprietary technology and unique regulatory licenses. The technology aims to modernize key banking and investing infrastructure to help enterprises safely grow their business and protect their customer assets. Continue reading.

Houston immunotherapy company 7 Hills Pharma to use $13.5M CPRIT grant to further develop cancer treatments

7 Hills Pharma, an innovative immunotherapy company, was awarded a $13.5 million grant from the Cancer Prevention and Research Institute of Texas. Photo via Getty Images

Between Bangalore and Chennai in the Indian state of Andhra Pradesh, you’ll find the town of Tirupati. It’s home to seven peaks that host a Hindu temple complex devoted to a form of Vishnu, Venkateshvara. It is also the region from which Upendra Marathi originally hails. It’s where his father, and many other family members, attended medical school.

“My father’s first job was to take care of the pilgrims,” recalls Marathi.

It's only natural that his groundbreaking Houston company would be named 7 Hills Pharma.

“That sort of selflessness and giving back, I wanted to embody it in the name of the company,” Marathi says.

Now, 7 Hills Pharma is announcing that last month, it was awarded a $13.5 million grant from the Cancer Prevention and Research Institute of Texas (CPRIT). That’s on top of more than $13 million in NIH grants, making the company the second largest recipient of SBIR/STTR grants in Texas. Continue reading.

Seattle biotech co. OncoResponse to move to Houston thanks to $13.3M grant from CPRIT

OncoResponse in partnership with MD Anderson Cancer Center received a portion of $73 million the Cancer Prevention and Research Institute of Texas has doled out this spring. Photo via oncoresponse.com

A biotech company has landed a more than $13 million grant from the Cancer Prevention and Research Institute of Texas.

The nearly $13.3 million grant given to OncoResponse — which is relocating from Seattle to Houston, according to CPRIT's news release — will help the company develop fully human monoclonal antibodies for treatment of cancer that otherwise would not respond to immunotherapy. OncoResponse already has a partnership with MD Anderson Cancer Center, which is one of the company’s investors.

“We are thrilled to receive this recognition from CPRIT in supporting the potential of our immunotherapy candidate OR502. We greatly appreciate the additional support from our investors as we continue to make significant progress with our drug development efforts advancing immunotherapies derived from clues of Elite Responders,” says Clifford Stocks, CEO of OncoResponse, in a news release. Continue reading.

Houston biotech startup CellChorus secures $2.3M SBIR grant

CellChorus, a biotech startup operating out of the University of Houston Technology Bridge, has secured fresh funding. Photo via Getty Images

They say it’s all in the timing. For CellChorus, it’s all in the TIMING. That’s Time-lapse Imaging Microscopy In Nanowell Grids. TIMING is a visual AI program that evaluates cell activation, killing and movement, which allows scientists to better understand how cells function.

The technology is important to the development of novel therapies in the realms of oncology, infectious diseases, and countless other disorders and diseases. By allowing scientists to observe those maladies at their roots, it will enable them to create, and ultimately deliver new medications and other therapies faster, at lower cost, and with a higher success rate.

CellChorus is a spinoff of the Single Cell Lab at the University of Houston. Part of UH’s Technology Bridge, CEO Daniel Meyer connected with co-founder and leader of Single Cell Lab, Navin Varadarajan, through co-founder Laurence Cooper.

“The company had been established, but there were limited operations,” recalls Meyer during a phone call with InnovationMap.

That was the fall of 2020. Now, the team has just announced a $2.3 million SBIR (Small Business Innovation Research) Fast-Track grant from the National Institute of General Medical Sciences. Continue reading.

Health tech startup Rosarium Health raises $1.7M, plans Houston HQ

Rosarium Health, a member of the Texas Medical Center's 2023 Accelerator for HealthTech cohort, has raised pre-seed funding. Photo courtesy of TMC

A health tech startup that just collected $1.7 million in pre-seed funding aims to eventually plant its headquarters in Houston.

The startup, Rosarium Health, currently has no headquarters; its 10 employees work remotely from various locations. However, co-founder and CEO Cameron Carter — who lives in the Denver area — says the company is eyeing a future headquarters in Houston.

“We believe Houston is the best city to launch a health care startup, given the Texas Medical Center, diverse talent across health and technology, affordable living, and a city with supportive and progressive communities,” Carter tells InnovationMap. “We feel Houston offers meaningful attributes that can enable a high-growth startup to succeed and for its employees to feel safe.” Continue reading.

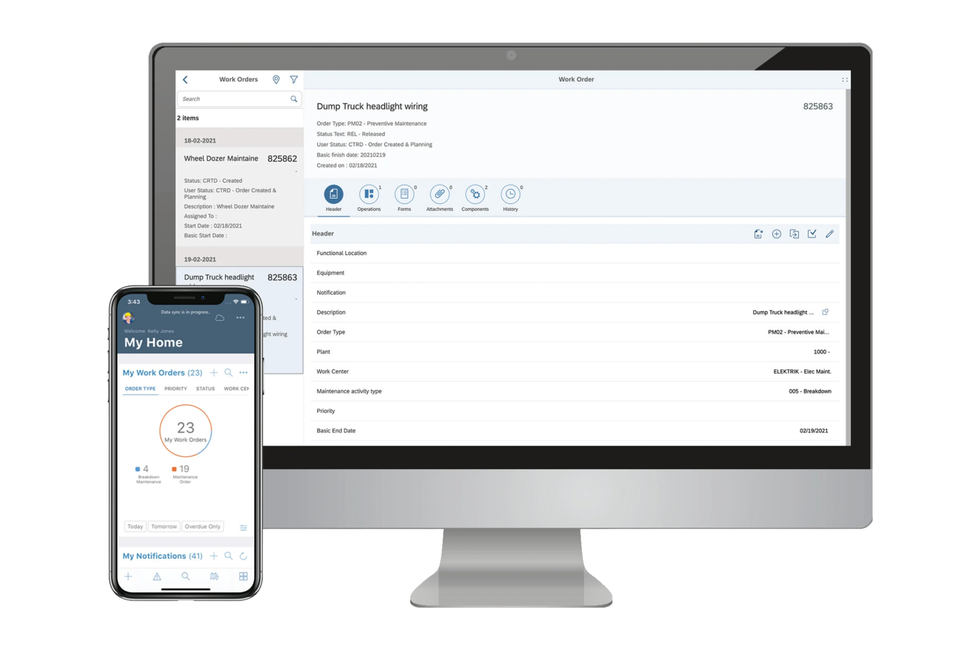

Houston-based workforce solutions platform Innovapptive closes series B round

A Houston SaaS company has announced a fresh round of funding. Photo via Innovapptive.com

A Houston software-as-a-service company has closed an undisclosed amount of funding in a series B round.

Innovapptive Inc., which has its global headquarters in Greenway Plaza, has announced it's closed a series B investment round led by Austin-based Vista Equity Partners with support from existing investor Tiger Global Management. The fresh funding will be deployed to "accelerate product innovation and reach new regional markets," according to the company.

“We look forward to this next phase of growth as we continue to define the emerging connected worker software category,” says Sundeep Ravande, founder and CEO of Innovapptive, in the news release. “Vista has significant experience scaling enterprise software businesses and emerging technologies." Continue reading.

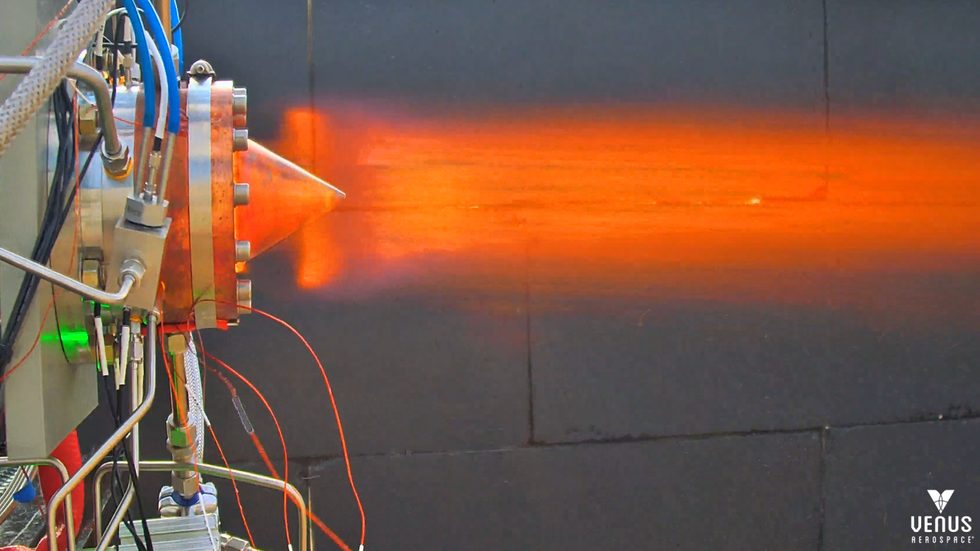

Venus Aerospace, a Houston startup with hypersonic engine tech, adds new investor

This Houston company is one step closer to enabling high-speed global travel. Photo courtesy of Venus Aerospace

A Houston-based company that's developing an engine that'll enable one-hour global transportation has announced its latest investor.

Venus Aerospace released the news that Silicon Valley venture capital firm, Airbus Ventures, has joined its team of investors. The supersonic combustion engine technology — more akin to a rocket's engine than an airplane's — is revolutionary because allows for travel at a higher elevation. Jet engines rely on air outside of the aircraft to combust, and rocket engines work with a system that supplies air internally.

“Venus has developed the world’s first liquid-propellant rotating detonation rocket engine (RDRE) with a double-digit percentage increase in efficiency over standard regular engines, making the hypersonic economy possible,” says Sassie Duggleby, CEO and co-founder of Venus, in a news release. “We’re delighted to bring Airbus Ventures into the Venus family and look forward to growing our collaboration as we harness the future of hypersonic flight.” Continue reading.

- Here's what Houston startups have raised in funding so far this year ›

- 10 Houston startups start 2023 with fresh venture capital funding ›

- Axiom Space, VenoStent, CardioOne, and more raise VC funding - InnovationMap ›

- Here's what Houston startups have raised in funding so far in 2024 - InnovationMap ›

- University of Houston lab report breakthrough in cancer-detecting technology - InnovationMap ›

- Cart.com acquires Amazon partner Amify - InnovationMap ›

- SmartAC.com secures fresh funding from Mercury to expand HVAC, plumbing platform - InnovationMap ›

Chart courtesy of

Chart courtesy of  Apple doubles down on Houston with new production facility, training center Photo courtesy Apple.

Apple doubles down on Houston with new production facility, training center Photo courtesy Apple.