Houston recognized for its workforce among top life science cities

we're no. 13

Of the top 25 United States metros ranked as the best for life science, Houston came in at lucky No. 13.

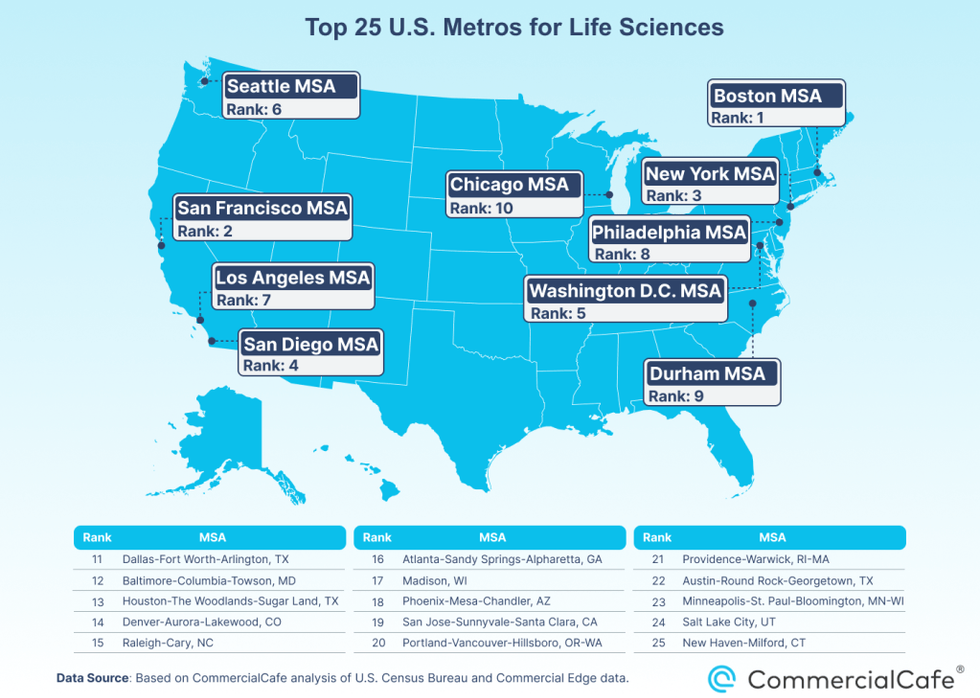

CommercialCafe issued a report this month ranking the top 25 U.S. cities for life science, factoring in volume of life science patents, number of life science establishments, size of workforce, educational institutions, office market, and more.

Houston stood out on the report for a few metrics. It might not be surprising, as Houston is home to the world's largest medical center, but the city boasts the 10th largest workforce with 5,100 workers employed in industry related occupations, the report found. Additionally, the city ranked:

- No. 8 for life science education — more than 860,000 area residents aged 25 years or older hold a bachelor’s degree in an industry related field.

- No. 9 for life science establishments — which has increased 23 percent since 2018 to a total of nearly 3,300.

- No. 9 for life science square footage added — with roughly 840,000 square feet of new life sciences projects currently in development

As positive as the report finds Houston's life science market, the ranking represents a decrease in ranking compared to 2022 where Houston scored a spot in the top 10. In fact, Houston can't even claim the top spot in the Lone Star State. No Texas cities made the top 10, but the Dallas area secured the No. 11 ranking. Dallas was also ranked highly for its talent pool.

Meanwhile in central Texas, Austin claimed the No. 22 spot. The full ranking is below.

Conveniently, CBRE, which also ranks the top life science markets every year, agrees with CommercialCafe's ranking of Houston. The 2023 report placed Houston at No. 13, which is exactly where the Bayou City ranked in 2022. However, according to CBRE, Houston ranks ahead of Dallas and Austin, which both still claimed rankings in the top 25.

- Report: Houston ranks in the top 10 life sciences markets in the U.S. ›

- Life science investment firm announces expansion into Houston ›

- Rice Alliance names most promising life science companies at annual forum ›

- Top life science startups revealed, recapping the Houston Innovation Awards, and more top stories ›

- Houston startups named most promising in the life science space at annual event ›

- Expert: Houston has potential to be a major hub for life sciences — if it addresses these concerns ›

Angela Holmes is the CEO of OmniScience. Photo via mercuryds.com

Angela Holmes is the CEO of OmniScience. Photo via mercuryds.com

Over 1,000 companies applied to participate in the 2023 MedTech Innovator Accelerator, 200 pitched in person, and 61 startups were selected. Graphic via

Over 1,000 companies applied to participate in the 2023 MedTech Innovator Accelerator, 200 pitched in person, and 61 startups were selected. Graphic via