Houston software company looks to grow its workforce internationally

Staffing up

A Houston-based analytics-focused company is gearing up for growth in 2019 and plans to staff up its headquarters and remote offices abroad.

Arundo Analytics Inc. brings industrial companies — which sometimes are slow to adopt brand-new technology — into the world of machine learning and advanced analytics to help boost revenue, cut costs and reduce risks.

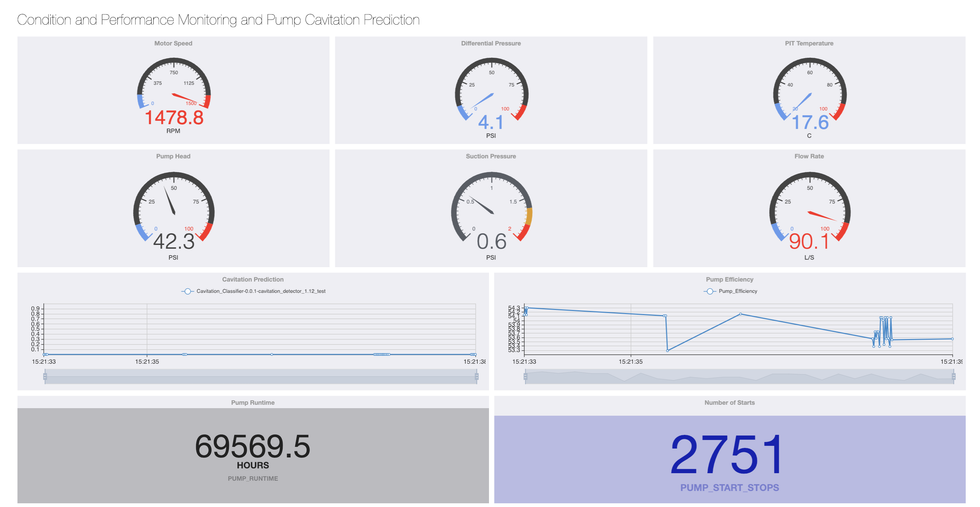

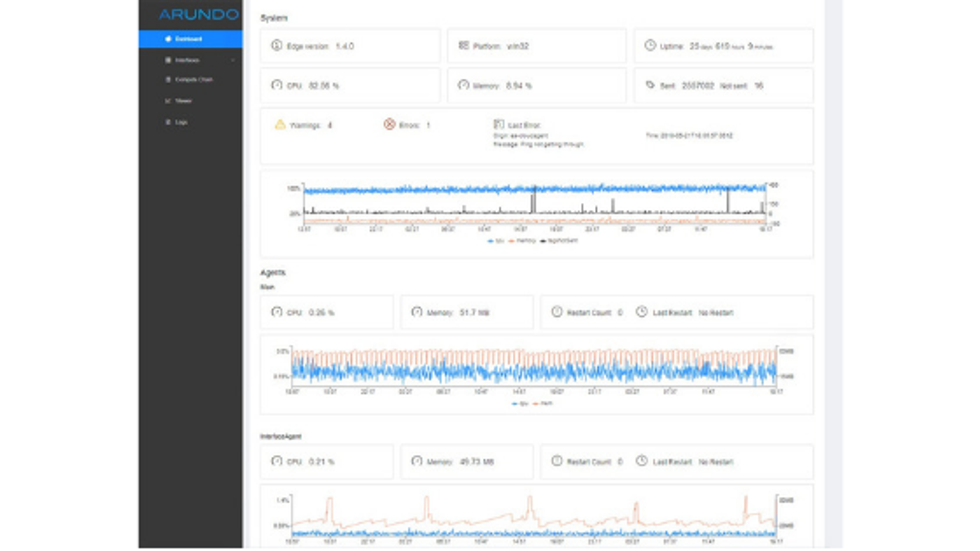

The startup's enterprise software gives asset-heavy industrial businesses "a virtual window into their day-to-day operations," says Stuart Morstead, co-founder and chief operating officer of Arundo. Among the operations that benefit from software are equipment maintenance, safety, logistics and scheduling.

Morstead points out that most industrial companies that encounter issues with operations such as equipment maintenance "lack the data science and software capabilities to drive value from insights into their daily operations."

Arundo aims to solve that problem by incorporating machine learning and advanced analytics — the kind of innovations emanating from the likes of Amazon, Google, and IBM — into everyday business operations at industrial companies, says Morstead, a former partner at consulting firm McKinsey & Co. and a graduate of Rice University.

Aside from its broad enterprise software, Arundo supplies out-of-the-box applications that tackle individual industrial challenges like flow metering for the offshore oil and gas industry and monitoring the condition of equipment. The virtual cloud-based multiphase flow meter is sold as part of a software package from industrial technology giant ABB.

More than 50 of Arundo's estimated 110 employees work on that technology from the startup's headquarters in downtown Houston. To propel its growth, Arundo plans to add employees this year in Houston as well as its other offices in Canada, Norway, Sweden and the United Kingdom, according to Morstead.

In 2016, Arundo graduated from Stanford University's StartX accelerator program. A year later, Arundo was named to the MIT STEX25 accelerator program by the Massachusetts Institute of Technology Startup Exchange.

Since its founding in 2015, Arundo has raised more $35 million in capital, including a Series A round of $28 million that closed in the first half of 2018. Investors include Sundt AS, Stokke Industri, Horizon, Canica, Strømstangen, Arctic Fund Management, Stanford-StartX Fund and Northgate Partners.

Aside from drawing more funding in 2018, the startup set up several strategic partnerships designed to increase the adoption of Arundo's software in sectors such as oil and gas, manufacturing, shipping, construction and maritime. Among the new partners are Dell Technologies, DNV GL's Veracity platform and WorleyParsons.

Going forward, Morstead says Arundo aims to bring its software expertise, business prowess and "world-class data science" to even more industrial companies and their physical assets as part of the global Industrial Internet of Things sector. That market is projected to approach $1 trillion by 2025, up from $100 billion in 2016.

To be sure, Arundo is competing in a market that's rife with opportunity. Consulting firm Accenture estimates the IIoT market could add $14.2 trillion to the global economy by 2030.

"Arguably the biggest driver of productivity and growth in the next decade, the Industrial Internet of Things will accelerate the reinvention of sectors that account for almost two-thirds of world output," the Accenture report says.

Tor Jakob Ramsøy, founder and CEO of Arundo, certainly grasps the enormous potential of IIoT.

"Asset-heavy companies can no longer afford to make business decisions based on an incomplete view of their organization," Ramsøy, a former McKinsey partner, said in a 2018 news release. "By combining deep data and [artificial intelligence] knowledge with decades of cumulative experience in enterprise consulting, Arundo is ushering in a new era in IIoT."