2021 will be a 'bipolar year' and other key takeaways from the Greater Houston Partnership's economic outlook

looking forward

As much of the world is ready to celebrate a new year — one likely to be drastically less affected by COVID-19 — the Greater Houston Partnership released an annual report about what Houston's economy will look like in 2021.

Senior vice president of research Patrick Jankowski and his team put the Houston Region Economic Outlook report together and shared some its highlights at a virtual event hosted by Bob Harvey, president and CEO of GHP.

Of course, much of the study focused on how the coronavirus — as well as the impending vaccine — will affect the region's economy.

"At this point last year, neither Patrick nor any of us could have predicted the arrival of COVID-19 and its devastating impact on the global economy," Harvey says at the event. "Here in Houston COVID wreaked havoc on industries across the spectrum from energy to hospitality."

In the early weeks, the Houston region lost 350,000 jobs, according to the report, and in the months since, the region added back about half with 176,000 jobs.

Below are some more key takeaways from the report — and in most cases, the outcome depends on how COVID-19 case numbers are affected by the holidays and the accessibility of the vaccine.

"The weeks and months ahead are likely to be some of the most difficult of the pandemic," Harvey cautions. "We cannot afford to let our guard down now as we approach the finish line."

Energy will continue to struggle

Photo via Getty Images

The past six years have been rough for oil and gas, and in Houston specifically, Houston has lost nearly 100,000 upstream energy jobs, and the energy industry's share of Houston's GDP has fallen from 35 to 40 percent (a GHP '14 estimate) to 20 to 25 percent (a GHP '19 estimate).

The Russia-Saudi Oil Feud in March brought this decline to its head and it's not looking like it's getting back to normal any time soon. "Next year won't be any easier for the industry. While global demand has improved, it will remain three to five million barrels per day below pre-COVID levels," reads the report.

The new administration is expected to have several goals that will affect the industry, such as bringing the U.S. back into the Paris Agreement, negotiating new mileage and emission rules for autos and trucks, slowing or halting oil leasing on federal lands and in the Gulf of Mexico, increasing environmental scrutiny during the pipeline permitting process, and more.

Jobs in some industries will come back

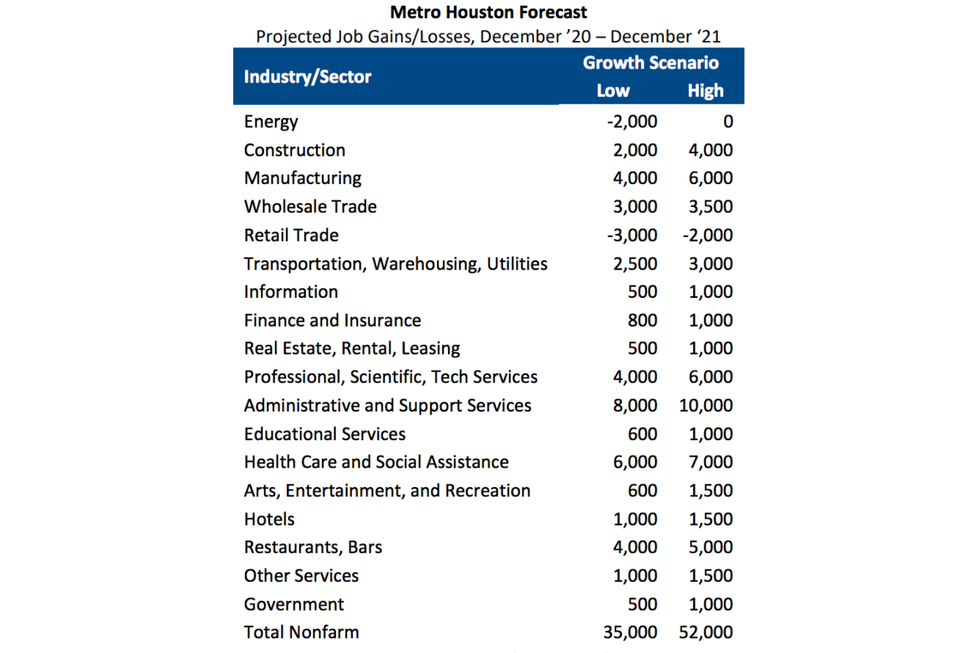

Chart via GHP

According to the report, Houston's unemployment rate, at 3.9 percent in February, jumped to 5.5 percent in March, then 14.3 percent in April — the highest on record.

"Unemployment has improved — we're at 7.9 percent now," Jankowski says at the event.

But recovery depends on the industry. Jankowski predicts that retail and energy are both expected to continue to lose jobs, and other industry sectors — such as government, arts and entertainment, and educational services — aren't expected to grow by much.

However, some of the sectors hardest hit in 2020 — construction, manufacturing, support services, and restaurants — are expected to bounce back with thousands of new jobs.

The chart gives a range of job growth — there's a lower and a higher outlook. Jankowski says it depends on how well the vaccine is doing.

If by mid-year, we don't have much of the population inoculated, it's going to be closer to that lower number," he says.

2021 will be a "bipolar year"

Patrick Jankowski of the GHP. Photo via Houston.org

The first and second halves of the year are going to look different, Jankowski says, it's just a matter of how different at this point. In addition to the vaccine and COVID case numbers, the things the GHP as well as Houston businesses are watching is the new Biden Administration

"We won't see any significant growth in the economy until we get to the second half of the year," he says

The first quarter of 2021 will be especially tough for Houston, according to the report, since the region always experiences job losses in January as retail, restaurant, and transportation workers hired for the holiday season are rolled off. Additionally, contract workers employed to meet year-end deadlines are released and plans for reorganization are implemented.

"No one should be surprised when Houston loses 40,000 or more jobs this January," the report reads. "Houston's recovery will likely lag the U.S.'s by a few months, but growth will resume in the second half of '21."