Editor's note: In this week's roundup of Houston innovators to know, I'm introducing you to four local innovators across industries — from financial edtech to geothermal energy — recently making headlines in Houston innovation.

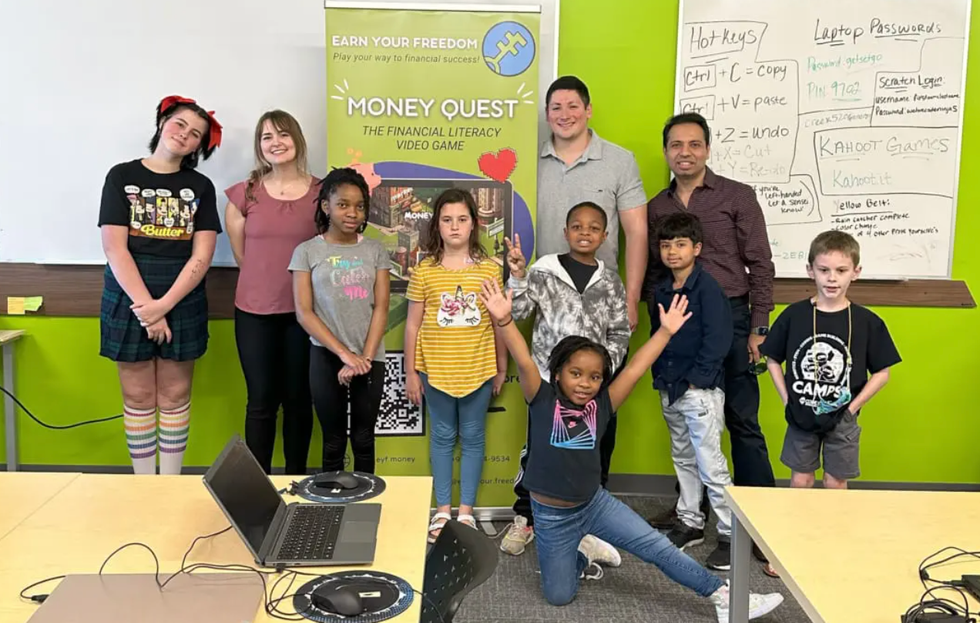

Grant Watkins and Keely McEnery, co-founders of Earn Your Freedom

Grant Watkins and Keely McEnery, co-founders of Earn Your Freedom, join the Houston Innovators Podcast. Photos courtesy of EYF

Houston-based Earn Your Freedom combines edtech, fintech, and gaming, as the co-founders, Grant Watkins and Keely McEnery explain on last week's episode of the Houston Innovators Podcast.

Both Watkins and McEnery have overcome personal finance obstacles, as they share on the show, and they aren't alone. Sixty-seven percent of Americans are considered financially illiterate, McEnery says, and 60 percent lives paycheck to paycheck.

"It's becoming more and more apparent how financially illiterate our country is," she continues. "It's a different mindset. People could be making $100,000 a year but if they don't know how to manage their money, they're still going to be in a cycle of not being financially free."

EYF's solution is a comprehensive, entertaining way for high school students to learn. And the timing is great, since Texas recently passed a bill about providing financial literacy education in high schools. Read more.

Richard Seline, co-founder and managing director of the Resilience Innovation Hub

A 130,000-square-foot Resilience Manufacturing Hub is coming to the Second Ward. Photo courtesy

Houston will soon have a 130,000-square-foot Resilience Manufacturing Hub that will house functions such as R&D, manufacturing, and assembly for products aimed at improving the resilience of homes, office buildings, warehouses, and other components of the “built environment.”

“We are looking for any product or technology solution that can reduce the impact from the next generation of disasters … by helping people thrive, not just survive, in their own community,” says Richard Seline, co-founder and managing director of the Houston-based Resilience Innovation Hub. The innovation hub is a partner in the manufacturing hub.

Seline says the manufacturing hub, with an estimated price tag of $32 million, will directly employ about 60 people. He expects the facility to either generate or “upskill” about 240 off-site jobs. Read more.

Tim Latimer, CEO and co-founder of Fervo Energy

Houston-based Fervo Energy shared the results of its commercial pilot project with Google. Photo via LinkedIn

Houston-based Fervo Energy announced this week that its commercial pilot project has resulted in continuous carbon-free geothermal energy production. The full-scale commercial pilot, Project Red, is in northern Nevada and made possible through a 2021 partnership with Google.

“By applying drilling technology from the oil and gas industry, we have proven that we can produce 24/7 carbon-free energy resources in new geographies across the world," Tim Latimer, Fervo Energy CEO and co-founder, says in a news release. "The incredible results we share today are the product of many years of dedicated work and commitment from Fervo employees and industry partners, especially Google." Read more.