How this Houston-headquartered company is innovating the future of heart replacement

HOUSTON INNOVATORS PODCAST EPISODE 183

Heart disease is one of the most common causes of death in the United States — one in five deaths, according to the CDC. But there's not a long-term solutions for patients — even for those lucky enough to have a successful heart transplant. But a Houston-headquartered medical device company is working on one.

BiVACOR has created a technology that, theoretically, could completely replace a patient's heart and last them the rest of their lives.

"The design is critical," says Thomas Vassiliades, CEO of BiVACOR, on the Houston Innovators Podcast. He joined the organization last year after spending 20 years of a heart surgeon, then transitioning to medical device development over a decade ago.

Vassiliades explains the industry's challenges on the show, saying that there's no comprehensive, lasting replacement to the human heart on the market. While some treatments — like transplants and medical devices that partially replace the heart's capabilities — exist, nothing that completely replaces the heart lasts longer than 10 to 12 years.

"The BiVACOR system is based on magnetic levitation," Vassiliades says about the technology. "Our pump is just one moving impeller that sits in the middle of the housing where the blood is. Imagine an artificial heart — the container that has your blood — and the device spinning in the inside — basically a wheel spinning your blood to the rest of your body.

"The device is suspended by magnets — it's not touching anything," he continues. "So, theoretically, the device has no wear and can last as long as the patient can possibly live. That's new to the field."

Daniel Timms, BiVACOR's founder and CTO, knew there had to be a better, more permanent solution and has been working on the technology since he was a postdoctoral student at Queensland University of Technology in Australia. His work took him to Houston's Texas Heart Institute, the "center of the universe when it comes to blood pumps," says Vassiliades.

The company recently raised $18 million in funding to support its growing team and continued growth. BiVACOR is a Class 3 medical device — the most rigorously regulated type of device, so the funding raised will support the company as it continues to meet the FDA's requirements and proceeds into implantation and clinical trials.

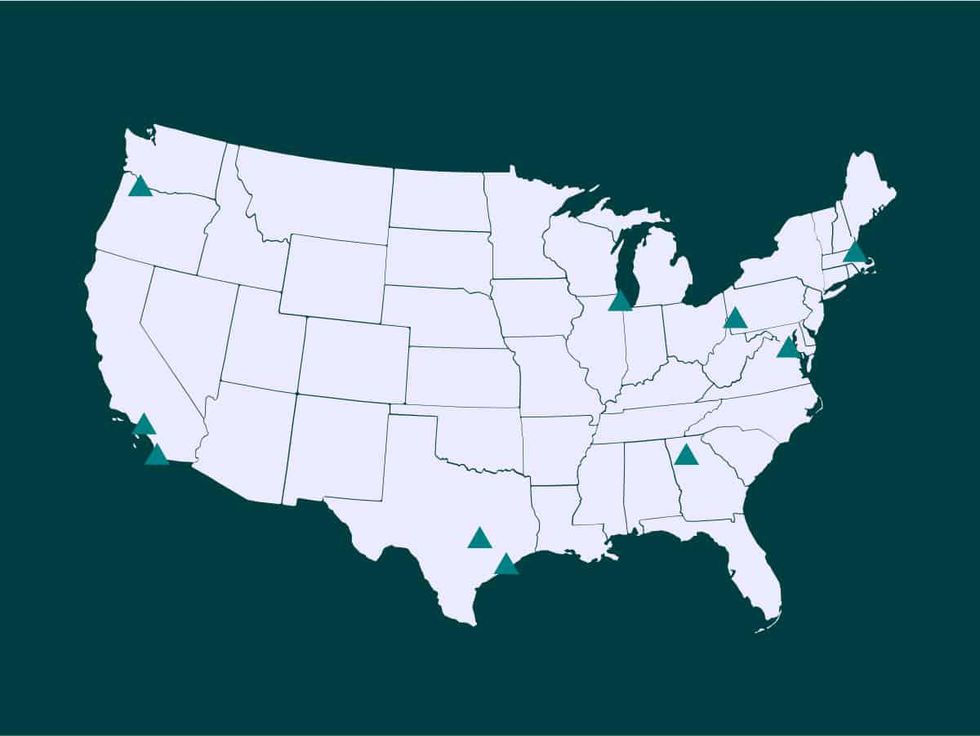

While headquartered in Houston and has close ties to THI, most of BiVACOR's team works out of Huntington Beach, California, just 30 minutes away from its manufacturing partner — something that has been critical for the design phase. Other employees work in Europe and Australia, which has resulted in government grant funding. Each market the company works in has a strategic purpose — and Houston's role is testing.

"We're going to be training all our clinical sites in Houston, and we're going to continue to do ongoing testing," he says. "We're very comfortable with the design of the device, ... but there's always more. And we have a long-term plan to iterate on the device to make it even better."

Vassiliades shares more of the challenges he's facing as he commercializes BiVACOR's technology on the podcast. Listen to the interview below — or wherever you stream your podcasts — and subscribe for weekly episodes.

Apple doubles down on Houston with new production facility, training center Photo courtesy Apple.

Apple doubles down on Houston with new production facility, training center Photo courtesy Apple.