Editor's Picks: 7 favorite Houston Innovator Podcast episodes of 2024

year in review

Editor's note: This year, recorded over 40 episodes of the Houston Innovators Podcast — a weekly discussion with a Houston innovator, startup founder, investor, and more. I've rounded up seven podcast episodes that stood out for me looking back at the year of recordings. Scroll through to see whom I selected and stream their individual episodes, and tune into the last episode of the year where I explain why I enjoyed each conversation.

Episode 220 - Better than just 'inclusive' - Denise Hamilton of WatchHerWork

Houstonian Denise Hamilton is coming out with a book she hopes helps leaders reach beyond inclusivity. Photo courtesy of WatchHerWork

Denise Hamilton says she's been used to looking around and realizing she's the only woman or African American in the room, and for the past nine years, she's been providing resources and education to trailblazing women like her. Now, she wants to prepare current and future leaders on how to go beyond inclusivity and work toward indivisibility.

Hamilton's book, "Indivisible: How to Forge Our Differences into a Stronger Future," publishes February 6 from Countryman Press. She explains that the book comes from years of her on personal experiences, as well as inspiration from the women she's met with her company, WatchHerWork, multimedia digital platform providing advice and resources for professional women.

"I've learned a lot of lessons about what skills work, what behaviors are not intuitive, and built WatchHerWork with the intention of creating a space where people can get all of that advice — and juicy goodness — so that they can learn what they needed to do to be authentically successful," Hamilton says on the Houston Innovators Podcast.

"This led to me being brought in as a speaker, and ultimately has led to me becoming an author," she continues. "It's always shocking when people want to listen to what you want to say. It's unbelievable." Continue reading the original article.

Episode 231 - Fostering a collaborative energy transition ecosystem - Barbara Burger

Houston energy leader Barbara Burger joins the Houston Innovators Podcast to discuss the energy transition's biggest challenges and her key takeaways from CERAWeek. Photo courtesy

When Barbara Burger moved to Houston a little over a decade ago to lead Chevron Technology Ventures, she wondered why the corporate venture group didn't have much representation from the so-called energy capital of the world.

“I had no companies in my portfolio in CTV from Houston, and I wondered why,” Burger says on the Houston Innovators Podcast.

Much has changed in the ecosystem since then, she says, including growth and development to what the community looks like now.

“There are a few things I’m proud of in the ecosystem here, and one of theme is that it’s a very inclusive ecosystem,” she explains, adding that she means the types of founders — from universities or corporate roles — and the incumbent energy companies. “The worst way to get people to not join a party is to not invite them.”

“No one company or organization is going to solve this. We have to get along,” she continues. “We have to stop thinking that the mode is to compete with each other because the pie is so big and the opportunity is so big to work together — and by and large I do see that happening.” Continue reading the original article.

Episode 233 - How a Houston angel earns their wings - Mitra Miller of Houston Angel Network

Mitra Miller, vice president and board member of the Houston Angel Network, joins the Houston Innovators Podcast to share her passion for growing angel investors in Houston. Photo via LinkedIn

One of the biggest components of a well-functioning startup ecosystem is inarguably access to capital, and Mitra Miller is dedicated to enhancing education around investment and growing Houston's investor base.

As vice president and board member of the Houston Angel Network, the oldest angel network in Texas and one of the most active angel networks in the country, Miller strives to provide guidance to new and emerging angel investors as well as founders seeking to raise money from them.

"Most founders have no idea or understanding of how investors think — we are not an ATM," Miller says on the Houston Innovators Podcast. "We are really partners you are getting married to for the next 5, 8, 10 years — sometimes longer. We need to bring your allies in every sense of the word." Continue reading the original article.

Episode 237 - Gearing up for 100x growth - Tim Latimer of Fervo Energy

Tim Latimer, CEO and co-founder of Fervo Energy, joins the Houston Innovators Podcast. Photo courtesy of Fervo Energy

Geothermal energy has been growing in recognition as a major player in the clean energy mix, and while many might think of it as a new climatetech solution, Tim Latimer, co-founder and CEO of Fervo Energy, knows better.

"Every overnight success is a decade in the making, and I think Fervo, fortunately — and geothermal as a whole — has become much more high profile recently as people realize that it can be a tremendous solution to the challenges that our energy sector and climate are facing," he says on the Houston Innovators Podcast.

In fact, Latimer has been bullish on geothermal as a clean energy source since he quit his job as a drilling engineer in oil and gas to pursue a dual degree program — MBA and master's in earth sciences — at Stanford University. He had decided that, with the reluctance of incumbent energy companies to try new technologies, he was going to figure out how to start his own company. Through the Stanford program and Activate, a nonprofit hardtech program that funded two years of Fervo's research and development, Latimer did just that. Continue reading the original article.

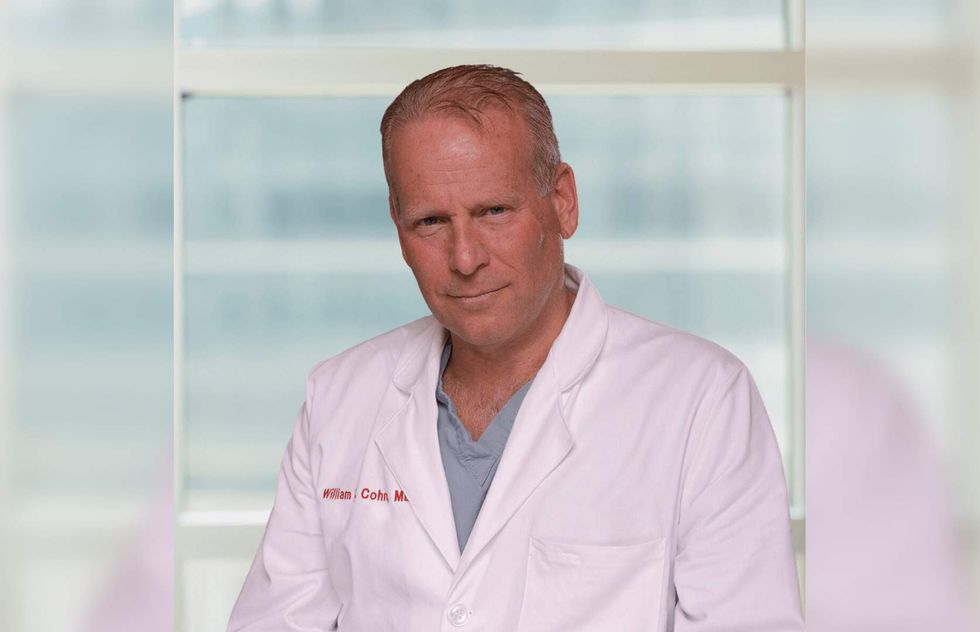

Episode 248 - Houston's beating heart - Dr. William Cohn of The Texas Heart Institute

Dr. William Cohn is the chief medical officer for BiVACOR, a medical device company creating the first total artificial heart. Photo via TMC

It's hard to understate the impact Dr. William Cohn has had on cardiovascular health as a surgeon at the Texas Heart Institute or on health care innovation as the director of the Center for Device Innovation at the Texas Medical Center. However, his role as chief medical officer of BiVACOR might be his most significant contribution to health care yet.

The company's Total Artificial Heart is unlike any cardiovascular device that's existed, Cohn explains on the Houston Innovators Podcast. While most devices are used temporarily for patients awaiting a heart transplant, BiVACOR's TAH has the potential to be a permanent solution for the 200,000 patients who die of heart failure annually. Last year, only around 4,000 patients were able to receive heart transplants.

"Artificial hearts historically have had bladders that ejected and filled 144,000 times a day. They work great for temporary support, but no one is suggesting they are permanent devices," Cohn says on the show. Continue reading the original article.

Episode 251 - Building enduring innovation ecosystems - Jon Norby of Anthropy Partners and EconWerx

Jon Nordby's career has been focused on cultivating a culture for innovation, and now he's focused on human potential technology opportunities. Photo courtesy

In his role overseeing startup accelerators for MassChallenge, Jon Nordby started noticing one industry vertical stood out in terms of success and opportunities: Human potential. Now, Nordby is a founding member of an investment firm looking for those opportunities.

Nordby, who served in various leadership roles at MassChallenge — including managing director and head of ecosystems — said he started realizing the opportunities within the organization's space and sports tech programs.

"What we realized over a couple of years running the program was that sports tech as a theme was too limiting," Nordby says on the Houston Innovators Podcast. "We were finding really great technologies, but we were limited at the market size of teams and leagues to deploy those technologies."

"Over the course of that program, we found that the things that were related more to human health and performance tended to out perform all of the other things related to sports tech — like media, entertainment, gambling," Nordby continues. "Still really great markets for those technologies, but we found a lot more traction for human performance." Continue reading the original article.

Episode 263 - Maintaining a legacy of innovation - Reginald DesRoches of Rice University

Rice University President Reginald DesRoches joins the Houston Innovators Podcast to discuss balancing tradition with growth, innovation, and global impact in education. Photo courtesy Tommy LaVergne/Rice University

How does a historic university maintain its legacy while still making room for growth and increased opportunities? That's what Rice University President Reginald DesRoches considers with every decision he makes.

"It's this idea of preserving what's special about the university, while also knowing we need to adapt to a new time, a new Rice, a new time in higher ed, and a new time in society," DesRoches says on the Houston Innovators Podcast. "There's a healthy tension between preserving what Rice is known for — the culture of care, the close-knit community — while knowing that we need to grow, have a global impact, and position Rice on a global scale. It's something that's constantly in my mind to make sure we do both." Continue reading the original article.