Here are the 10 most-read Houston innovation headlines of 2025

Year in Review

Editor's note: As we ring in the new year, we're looking back at the stories that defined Houston innovation in 2025. The 10 most-read InnovationMap stories of the year highlight diversity, mentorship, and the startups that are shaping the future.

Houston named No. 2 most diverse major U.S. city for 2025

Houston is the No. 2 most diverse large city and the No. 5 most diverse city overall in America. Sky Noir Photography by Bill Dickinson/Getty Images

Houston has always been a diverse place, embracing people of many different cultural and socioeconomic backgrounds. The city earned recognition in WalletHub's rankings of the most diverse large American cities for 2025. The 2025 edition was the final installment in WalletHub's diversity study series, which annually compared 501 U.S. cities across 13 metrics in five categories that encompass "diversity" across socioeconomic, cultural, economic, household, and religious factors. Houston nearly topped the list of large U.S. cities, coming in at No. 2, and it ranked No. 5 in the overall national comparison.

What to know about the new emission inspection to register your car in Texas

An inspection is no longer required to renew registration, but an emission evaluation is. Photo by Tim Leviston/Getty Images

As of January 1, 2025, Texas vehicle owners no longer needed to obtain a safety inspection prior to vehicle registration. House Bill 3297, which passed during the 88th Legislature in 2023, eliminated the safety inspection program for non-commercial vehicles. But under the new law, the $7.50 fee that drivers had to pay as a safety inspection fee has not gone away. It now appears on your registration notice under a new name: "Inspection Program Replacement Fee."

Houston humanoid robotics startup secures millions in pre-seed funding

A concept design rendering of Persona AI's humanoid robot. Co-founder and CEO Nic Radford expects customers to take delivery of its first robot in 18 to 24 months. Rendering courtesy Persona AI.

In February 2025, a Houston-based startup developing AI-powered humanoid robots for manufacturers and other businesses raised more than $10 million in pre-seed funding — less than a year after its founding. Nic Radford, co-founder and CEO of Persona AI, declined to disclose the amount raised, however, he told InnovationMap that it was an eight-figure total.

2 Houston universities declared among world’s best in 2026 rankings

Rice is the No. 2 best school in Texas, and No. 119 in the world. Photo via Rice University

Two Houston universities were in a class of their own, earning top spots on a global ranking of the world's best universities. Rice University and University of Houston were among the top 1,200 schools included in the QS World University Rankings 2026. Ten more schools across Texas made the list.

Announcing the 2025 Houston Innovation Awards finalists

Meet the finalists for the Houston Innovation Awards, taking place Nov. 13. Graphic via Gow Media

In October 2025, InnovationMap was proud to reveal the finalists for the fifth-annual Houston Innovation Awards. This year's finalists were determined by an esteemed panel of judges, comprised of past award winners and InnovationMap editorial leadership, and they represented the best of Houston innovation this year.

Meet 6 mentors who are helping the Houston startup scene flourish

The 2025 Mentor of the Year will be announced on Nov. 13. Courtesy photos

The 2025 Mentor of the Year will be announced on Nov. 13. Courtesy photosFew founders launch successful startups alone — experienced and insightful mentors often play an integral role in helping business and founders thrive. The Houston startup community is home to many mentors who are willing to lend an ear and share advice to help entrepreneurs meet their goals. The Mentor of the Year category in our 2025 Houston Innovation Awards honored an individual like this, who dedicates their time and expertise to guide and support budding entrepreneurs. The award was presented by Houston City College Northwest.

Houston Nobel Prize nominee earns latest award for public health research

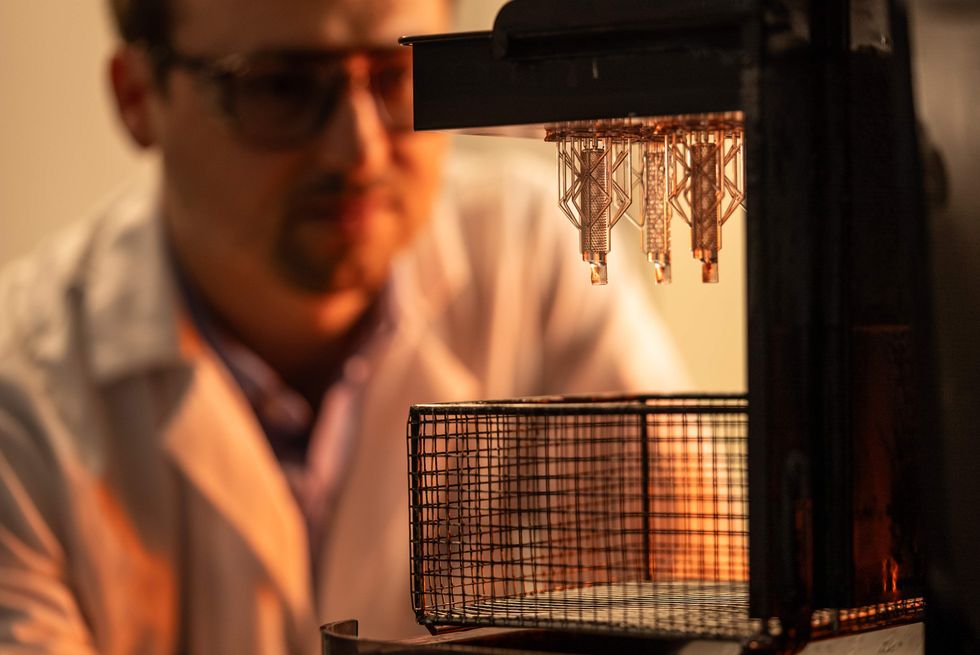

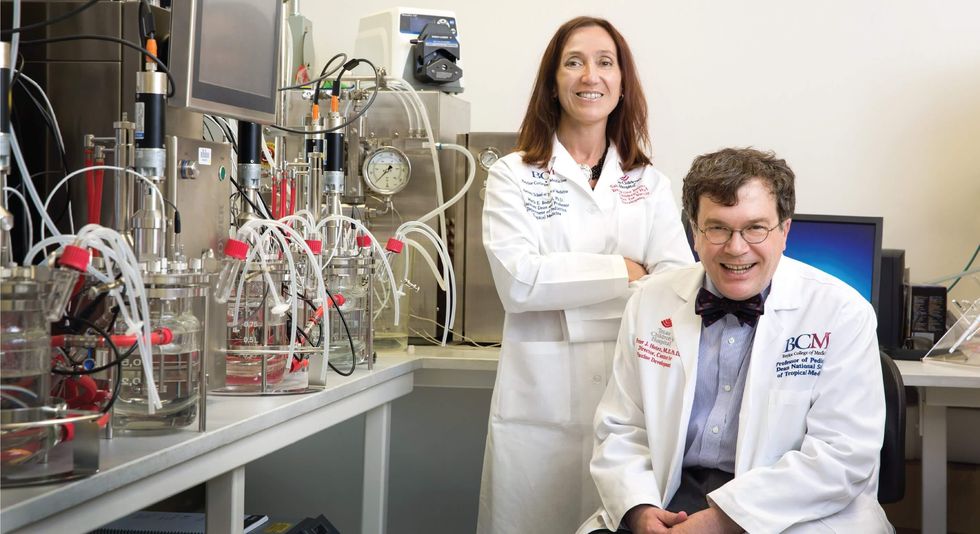

Dr. Peter Hotez with Dr. Maria Elena Bottazzi. Photo courtesy of TMC

Houston vaccine scientist Dr. Peter Hotez added one more prize to his shelf. Hotez — dean of the National School of Tropical Medicine and professor of Pediatrics and Molecular Virology & Microbiology at Baylor College of Medicine, co-director of the Texas Children’s Center for Vaccine Development (CVD) and Texas Children’s Hospital Endowed Chair of Tropical Pediatrics — is no stranger to impressive laurels. In 2022, he was even nominated for a Nobel Peace Prize for his low-cost COVID vaccine. His big win of 2025 was this year’s Hill Prize, awarded by the Texas Academy of Medicine, Engineering, Science and Technology (TAMEST).

Apple announces 250,000-square-foot Houston factory as part of $500B plan

Apple's Houston factory will open in 2026. Getty Images

As part of a more than $500 billion, four-year investment across the U.S., Silicon Valley tech giant Apple announced plans to build a factory in Houston that will produce servers for its data centers to support the company’s artificial intelligence (AI) business. In a February 24 announcement, Apple said the company and its partners will build the 250,000-square-foot factory. The plant, set to open in 2026, will employ thousands of people.

10 Houston billionaires make Forbes' list of richest Americans in 2025

Pictured: Nancy and Richard Kinder, the richest Houstonian, according to the Forbes 400. Photo by Michelle Watson/Catchlight Group

America's wealthiest billionaires were $1.2 trillion richer in 2025, bringing their collective worth to a staggering $6.6 trillion. And Houston's own Richard Kinder became the richest billionaire in the city, according to the annual Forbes 400. The Kinder Morgan chairman was named the 11th richest Texas resident and ranked as the 108th richest American. He dethroned Tilman Fertitta to claim the title as the wealthiest Houstonian.

2 Houston suburbs named among 10 best places to live by U.S. News & World Report

Pearland is the No. 2 best place to live in the U.S. Photo via pearlandedc.com

The Houston suburbs of Pearland and League City landed among the top 10 best places to live in 2025, according to U.S. News & World Report. For the 2025-2026 "Best Places to Live in the U.S." rankings, U.S. News expanded its coverage from 150 to 250 U.S. cities, and updated its methodology to examine each city based on five livability indexes: Quality of life, value, desirability, job market, and net migration. Pearland ranked No. 3 nationwide, earning a 7.0 score alongside No. 1-winning Johns Creek, Georgia and No. 2 winner Carmel, Indiana.