New accelerator for AI startups to launch at Houston's Ion this spring

The Collectiv Foundation and Rice University have established a sports, health and wellness startup accelerator at the Ion District’s Collectiv, a sports-focused venture capital platform.

The AI Native Dual-Use Sports, Health & Wellness Accelerator, scheduled to formally launch in March, will back early-stage startups developing AI for the sports, health and wellness markets. Accelerator participants will gain access to a host of opportunities with:

- Mentors

- Advisers

- Pro sports teams and leagues

- University athletics programs

- Health care systems

- Corporate partners

- VC firms

- Pilot projects

- University-based entrepreneurship and business initiatives

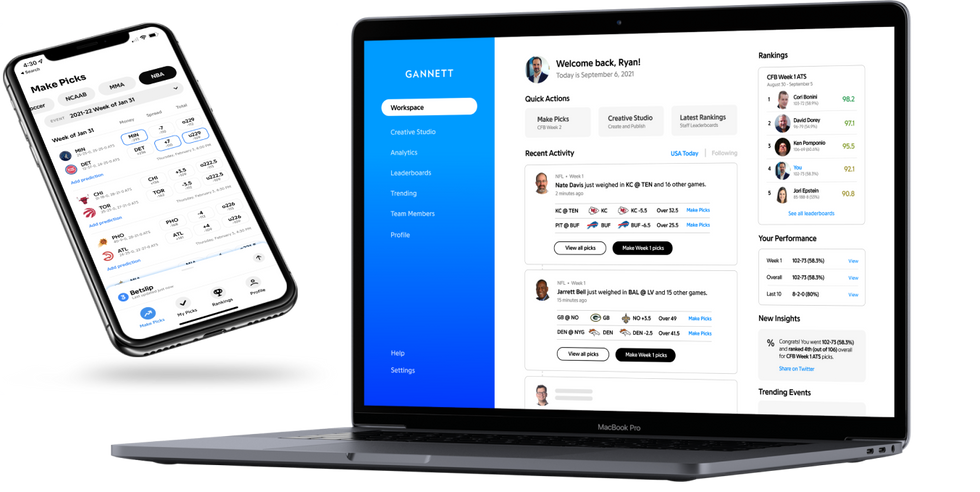

Accelerator participants will focus on sports tech verticals inlcuding performance and health, fan experience and media platforms, data and analytics, and infrastructure.

“Houston is quickly becoming one of the most important innovation hubs at the intersection of sports, health, and AI,” Ashley DeWalt, co-founder and managing partner of The Collectiv and founder of The Collectiv Foundation, said in a news release.

“By launching this platform with Rice University in the Ion District,” he added, “we are building a category-defining acceleration engine that gives founders access to world-class research, global sports properties, hospital systems, and venture capital. This is about turning sports-validated technology into globally scalable companies at a moment when the world’s attention is converging on Houston ahead of the 2026 World Cup.”

The Collectiv accelerator will draw on expertise from organizations such as the Rice-Houston Methodist Center for Human Performance, Rice Brain Institute, Rice Gateway Project and the Texas Medical Center.

“The combination of Rice University’s research leadership, Houston’s unmatched health ecosystem, and The Collectiv’s operator-driven investment platform creates a powerful acceleration engine,” Blair Garrou, co-founder and managing partner of the Mercury Fund VC firm and a senior adviser for The Collectiv, added in the release.Additional details on programming, partners and application timelines are expected to be announced in the coming weeks.

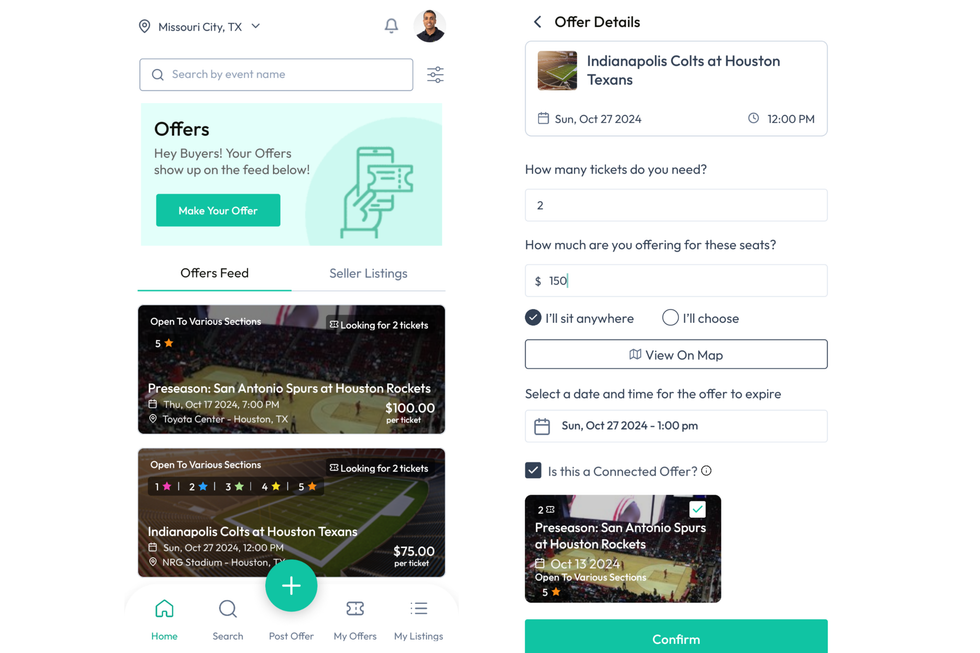

Offer Approved is a transparent and trusted platform for both sellers and buyers. Screenshots courtesy of Offer Approved

Offer Approved is a transparent and trusted platform for both sellers and buyers. Screenshots courtesy of Offer Approved Jerin Varkey founded Offer Approved to target unsold resale tickets to sporting events. Photo courtesy of Offer Approved

Jerin Varkey founded Offer Approved to target unsold resale tickets to sporting events. Photo courtesy of Offer Approved Erik Korem founded AIM7, which just closed $1.3 million in seed funding. Photo via aim7.com

Erik Korem founded AIM7, which just closed $1.3 million in seed funding. Photo via aim7.com