Seven Houston startups have started the new year strong with over $380 million in venture funding — most of which from one mega deal for a geothermal company.

According to InnovationMap reporting, Houston's VC activity in the first quarter of 2024 spanned industry and stage — from pre-seed to series E. It's a large chunk of money raised in Houston for one quarter — but not in terms of deals closed, at least compared to the previous quarter, in which startups raised over $170 million but across nine deals.

On the national side, it's not too different of a story. According to a quarterly report from PitchBook, the United State's VC activity for the start of the year "showed to be one of the slowest areas of the venture market during the quarter." Only $9.3 billion in capital was raised in the U.S. last quarter, which is only 11.3 percent of the total raised in the already slowed market of 2023.

"While dry powder remains high, slowed fundraising portends to LP hesitancy toward VC, and should predict a more difficult dealmaking environment down the road," reads an email from PitchBook. "During the past few years, large mega-funds drove fundraising trends, but Q1 VC fundraising shows there may be no appetite for such vehicles in today’s market."

These are the seven startup VC deals closed in Houston so far this year, according to reporting on InnovationMap.

Fervo Energy scored a $244 million round of funding thanks to existing and new investors. Photo via Fervo Energy

An Oklahoma-based shale oil and gas leader has backed Fervo Energy's latest round of funding, supporting the startup's geothermal technology yet again.

Fervo announced its latest round of funding this week to the tune of $244 million. The round was led by Devon Energy, a company that's previously backed the startup.

“Demand for around-the-clock clean energy has never been higher, and next-generation geothermal is uniquely positioned to meet this demand,” Tim Latimer, Fervo CEO and co-founder, says in a news release. “Our technology is fully derisked, our pricing is already competitive, and our resource pipeline is vast. This investment enables Fervo to continue to position geothermal at the heart of 24/7 carbon-free energy production.” Read more about the round.

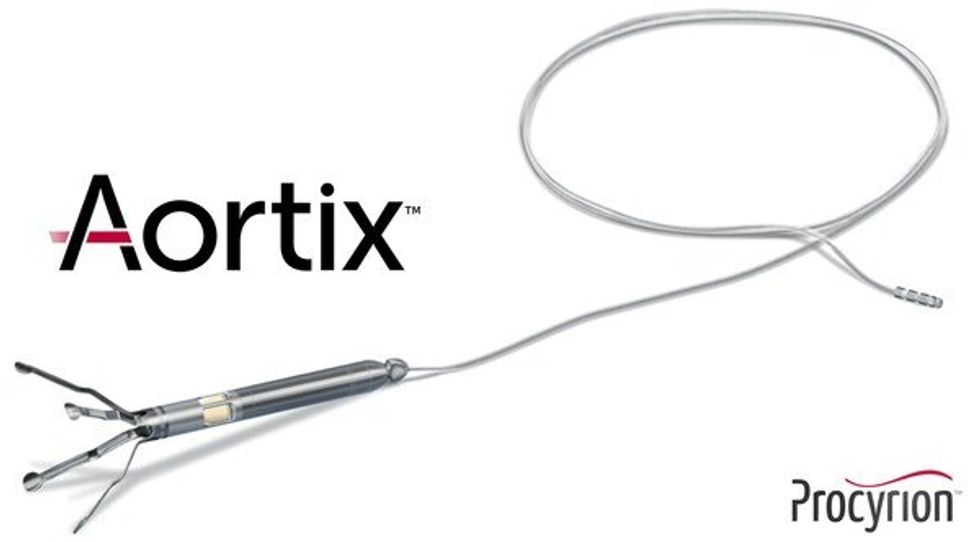

Procyrion has announced the closing of its series E round of funding. Photo via Getty Images

Houston-born and bred medical device company, Procyrion, has completed its series E with a raise of $57.7 million, including the conversion of $10 million of interim financing.

Procyrion is the company behind Aortix, a pump designed to be placed in the descending thoracic aorta of heart failure patients, which has been shown to improve cardiac performance in seriously ill subjects. The money raised will allow the company to proceed with a the DRAIN-HF Study, a pivotal trial that will be used for eventual FDA approval and commercialization.

The Aortix is the brainchild of Houston cardiologist Reynolds Delgado. According to Procyrion’s CSO, Jace Heuring, Delgado, gained some of his experience with devices for the heart working with legendary Texas Heart Institute surgeon O.H. “Bud” Frazier. He filed his first patents related to the Aortix in 2005. Read more about the round.

Houston-based Welligence Energy Analytics specializes in data and intelligence for the oil and gas markets, greenhouse gas emissions sector, and CCUS projects. Photo via Getty Images

A group of investors has chipped in $41 million to purchase a minority stake in Houston-based Welligence Energy Analytics, a provider of energy data and intelligence.

Boston-based venture capital firm Elephant Partners led the series B round, with participation from Veriten, a Houston-based, energy-focused research, investing, and strategy firm, and EDG, a Metairie, Louisiana-based energy consulting firm. Several executives from the energy, information services, and software sectors also contributed to the round.

Founded in 2016, Welligence specializes in data and intelligence for the oil and gas markets, greenhouse gas emissions sector, and carbon capture, storage, and utilization (CCUS) projects. Clients include major oil and gas companies, as well as large investment banks. Read more about the round.

Motif Neurotech, which develops minimally invasive bioelectronics for mental health treatment, closed its series A round with an oversubscribed $18.75 million. Photo via Rice.edu

A health tech startup based out of a newly formed accelerator program at Rice University has raised venture funding.

Motif Neurotech closed its series A round with an oversubscribed $18.75 million. The company, which develops minimally invasive bioelectronics for mental health treatment, was formed out of the Rice Biotech Launch Pad that launched last fall.

The round was led by Arboretum Ventures, with participation from new investors KdT Ventures, Satori Neuro, Dolby Family Ventures, re.Mind Capital and existing investors Divergent Capital, TMC Venture Fund, PsyMed Ventures, Empath Ventures and Capital Factory. Read more about the round.

Houston-based Sage Geosystems announced the first close of $17 million round led by Chesapeake Energy Corp. Photo via sagegeosystems.com

A Houston geothermal startup has announced the close of its series A round of funding.

Houston-based Sage Geosystems announced the first close of $17 million round led by Chesapeake Energy Corp. The proceeds aim to fund its first commercial geopressured geothermal system facility, which will be built in Texas in Q4 of 2024. According to the company, the facility will be the first of its kind.

The venture is joined by technology investor Arch Meredith, Helium-3 Ventures and will include support from existing investors Virya, LLC, Nabors Industries Ltd., and Ignis Energy Inc.

“The first close of our Series A funding and our commercial facility are significant milestones in our mission to make geopressured geothermal system technologies a reality,” Cindy Taff, CEO of Sage Geosystems, says in a news release. “The success of our GGS technologies is not only critical to Sage Geosystems becoming post-revenue, but it is an essential step in accelerating the development of this proprietary geothermal baseload approach. Read more about the round.

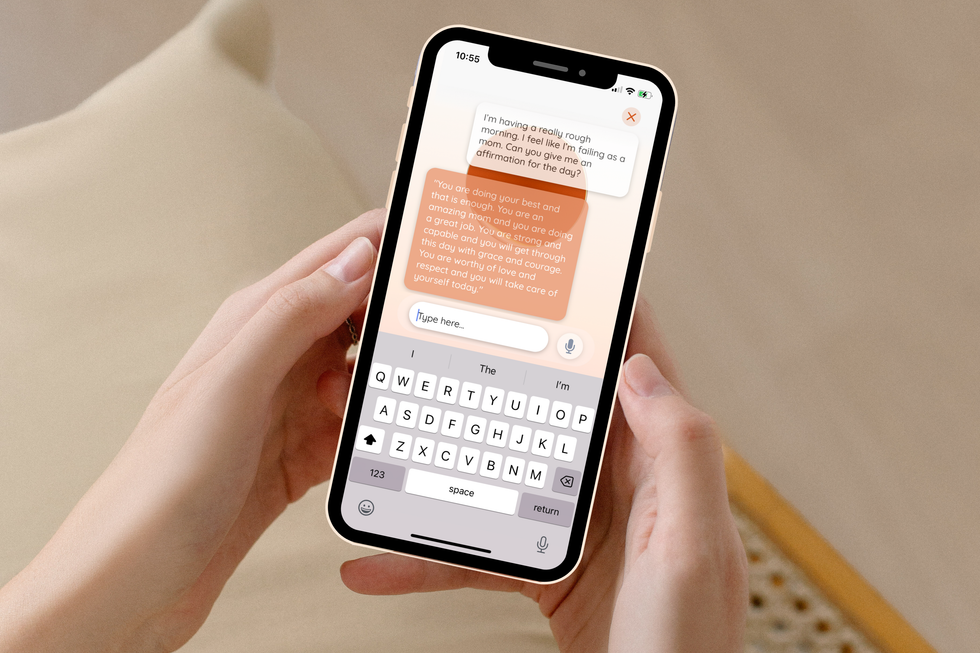

Ema, which operates as a health and wellness-focused, AI-based chat for women, has raised additional funding. Screenshot courtesy of Ema

A Houston-based startup that's improving health and wellness for women with its artificial intelligence-backed platform has raised a bridge round of funding.

Ema closed its latest bridge round, bringing its total funding to nearly $2 million. The company received investment from Kubera's Venture Capital and Victorum Capital, which joined existing investors Hearst Labs, Wormhole Capital, Acumen America, and Techstars.

Ema strives to deliver "personalized, empathetic, and evidence-based support" to its users through its generative AI technology. The platform has more than 100,000 users, and has expanded into the B2B sector with $100,000 in contracts within just 30 days after pivoting to this model, according to the company. Read more about the round.

The edtech company offers a comprehensive approach to shrinking the digital divide with a suite of technology including software, hardware, and more. Photo courtesy of TrueLeap

An edtech startup has just secured funding to further its mission of increasing accessibility to education.

TrueLeap Inc., global digital education startup addressing the digital divide in education, has raised $610,000, which is over its target of $500,000. The round was led by United Kingdom-based Maya Investments Limited.

"This oversubscribed funding round, led by Maya Investments Limited, is a testament to the urgent need for innovative educational technologies in emerging markets. Our commitment to providing affordable and integrated solutions is stronger than ever," says Sandip Bordoloi, CEO and Co-Founder of TrueLeap, in a news release. Read more about the round.

Aortix is a pump designed to be placed in the descending thoracic aorta of heart failure patients. Photo via Procyrion

Aortix is a pump designed to be placed in the descending thoracic aorta of heart failure patients. Photo via Procyrion