Houston physicist scores $15.5M grant for high-energy nuclear physics research

FUTURE OF PHYSICS

A team of Rice University physicists has been awarded a prestigious grant from the Department of Energy's Office of Nuclear Physics for their work in high-energy nuclear physics and research into a new state of matter.

The five-year $15.5 million grant will go towards Rice physics and astronomy professor Wei Li's discoveries focused on the Compact Muon Solenoid (CMS), a large, general-purpose particle physics detector built on the Large Hadron Collider (LHC) at CERN, a European organization for nuclear research in France and Switzerland. The work is "poised to revolutionize our understanding of fundamental physics," according to a statement from Rice.

Li's team will work to develop an ultra-fast silicon timing detector, known as the endcap timing layer (ETL), that will provide upgrades to the CMS detector. The ETl is expected to have a time resolution of 30 picoseconds per particle, which will allow for more precise time-of-flight particle identification.

This will also help boost the performance of the High-Luminosity Large Hadron Collider (HL-LHC), which is scheduled to launch at CERN in 2029, allowing it to operate at about 10 times the luminosity than originally planned. The ETL also has applications for other colliders apart from the LHC, including the DOE’s electron-ion collider at the Brookhaven National Laboratory in Long Island, New York.

“The ETL will enable breakthrough science in the area of heavy ion collisions, allowing us to delve into the properties of a remarkable new state of matter called the quark-gluon plasma,” Li explained in a statement. “This, in turn, offers invaluable insights into the strong nuclear force that binds particles at the core of matter.”

The ETL is also expected to aid in other areas of physics, including the search for the Higgs particle and understanding the makeup of dark matter.

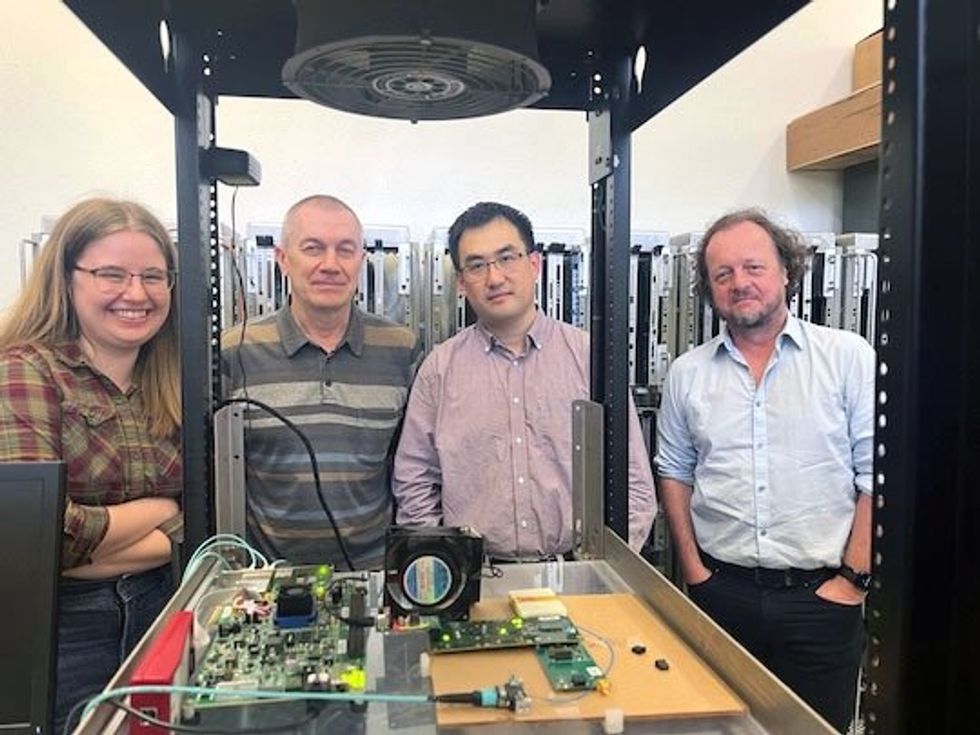

Li is joined on this work by co-principal investigator Frank Geurts and researchers Nicole Lewis and Mike Matveev from Rice. The team is collaborating with others from MIT, Oak Ridge National Lab, the University of Illinois Chicago and University of Kansas.

Last year, fellow Rice physicist Qimiao Si, a theoretical quantum physicist, earned the prestigious Vannevar Bush Faculty Fellowship grant. The five-year fellowship, with up to $3 million in funding, will go towards his work to establish an unconventional approach to create and control topological states of matter, which plays an important role in materials research and quantum computing.

Meanwhile, the DOE recently tapped three Houston universities to compete in its annual startup competition focused on "high-potential energy technologies,” including one team from Rice.------

This article originally ran on EnergyCapital.