Houston energy company exits, 3 recent investments from local fund, and more innovation news

Short stories

Houston's innovation ecosystem has been booming with news, and it's likely some might have fallen through the cracks.

For this roundup of short stories within Houston innovation, Texas Halo Fund makes three new investments, a Houston energy company exits, a growing Rice University startup gets grants, and more.

Octopus Energy acquires Houston-founded Evolve Energy

The $5 million deal means a new focus on Texas for the new parent company. Photo via evolvemyenergy.com

London-based renewable energy company Octopus Energy announced that it's acquired Houston-founded Evolve Energy in a $5 million deal, which represents Octopus's $100 million expansion into the United States market.

Octopus, which reached Unicorn status with a $1 billion valuation in April, will start its expansion in Texas, according to a news release, operating under the new name Octopus Energy US. Evolve Energy, which was founded in 2018 by Michael Lee, is a Texas-based Capital Factory portfolio company and finished first place in the 2019 EarthX startup competition. The company also has a Silicon Valley office, in addition to its local operation in Houston's Galleria area.

"Octopus Energy is inspirational in growing a customer base of over 1 million households in just four years. It has done so while also achieving customer satisfaction scores similar to Netflix and Amazon. It matches our aspiration for innovation and we're thrilled to be part of the Octopus family," says Lee in the release. "The US energy market is rapidly moving towards ultra-low cost renewable energy and is prime for a true digital transformation."

Texas Halo Fund makes three new investments

Here are the three latest investments from Texas Halo Fund. Getty Images

Houston-based Texas Halo Fund has made three recent investments in August and September.

- Nexus AI, based in Chicago, the workforce management tech company uses artificial intelligence and organizational behavioral science to predict the best teams or individuals for a project on the startup's cloud-based platform.

- Rellevate is a Connecticut-based digital fintech company that optimizes employer-based digital account and financial services.

- MFB Fertility, a Colorado company, has created game-changing at-home test stripts for assaying the hormone progesterone branded as Proov.

Rice University program seeking data projects

The Rice D2K Lab wants to help startups and small businesses solve business concerns with data science. Photo courtesy of Rice

Adata-focused lab at Rice University is seeking data challenges for its group of next generation of data scientists to solve. The Rice D2K Lab is looking for sponsors for its Rice D2K Capstone project in Spring 2021. Rice's D2K Capstone program forms interdisciplinary teams of advanced undergraduate and graduate students to solve pressing real-world data science challenges. The program is accepting project proposals for the Spring 2021 semester through Monday, October 19.

Click here to learn more about the program, and click here to get involved.

California startup joins Chevron's Catalyst Program

CTV has a new startup in its Catalyst Program. Photo via Getty Images

Houston-based Chevron Technology Ventures announced that Oakland, California-based Brimstone Energy Inc. has joined CTV's Catalyst Program to continue its development of its decarbonization platform, which focuses on the generation of low-emissions hydrogen, as well as various commodity products, according to a release.

"Brimstone Energy is excited to be supported by Chevron, a multi-national industrial company," says Cody Finke, Ph.D., co-founder and CEO of Brimstone Energy, in the release. "It is good to see Chevron continue to back companies with decarbonization in their mission."

Rice University-born startup racks up $12.5 million in grants

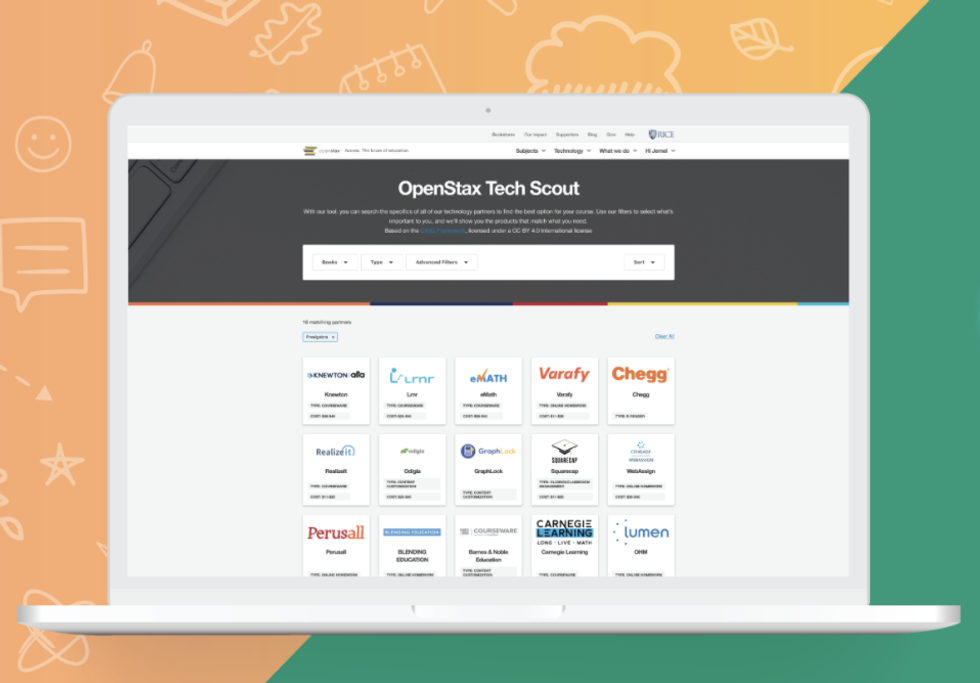

OpenStax is growing its access to free online textbooks. Image via openstax.org

Rice University's OpenStax is able to greatly expand its library of free online textbooks thanks to new grants totaling $12.5 million. The funds derive from Bill & Melinda Gates Foundation, the William and Flora Hewlett Foundation, the Charles Koch Foundation and the Stand Together community, according to a press release from Rice.

The new funds will more than double OpenStax's files from 42 books to 90. Already, the platform has saved 14 million students around the world more than $1 billion.

"Nine years ago, we dreamed about solving the textbook affordability and access crisis for students," says Richard Baraniuk, the Victor E. Cameron Professor of Electrical and Computer Engineering at Rice and founder and director of OpenStax, in the release. "Now, with this tremendous investment in open education, we will be able to not only accelerate educational access for tens of millions of students but also drive innovation in high-quality digital learning, which has become commonplace due to COVID-19."

OpenStax is planning to raise $30 million for continued library expansion as it aims to lower the barrier to higher education.