Editor's note: In this week's Monday roundup of Houston innovators, I'm introducing you to three innovators across the city — from the Greater Houston Partnership, The Ion, and Texas Heart Institute.

Patrick Jankowski, senior vice president of research

The Greater Houston Partnership hosted its annual economic outlook event online this week. Photo courtesy of the GHP

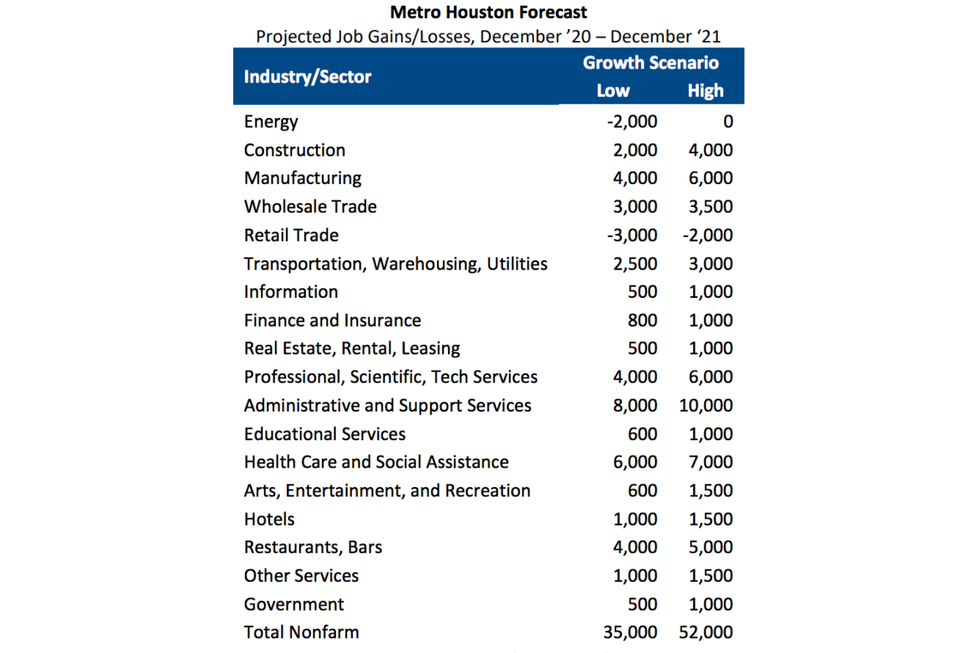

At the GHP's annual economic outlook, Patrick Jankowski, senior vice president of research, predicts that 2021 will be a "bipolar year." The first and second halves of the year are going to look different, Jankowski says, it's just a matter of how different at this point. In addition to the vaccine and COVID case numbers, the things the GHP as well as Houston businesses are watching is the new Biden Administration.

"We won't see any significant growth in the economy until we get to the second half of the year," he says. Read more.

Deanea LeFlore, director of partnerships at The Ion

Deanea LeFlore, director of partnerships at The Ion, joins this week's episode of the Houston Innovators Podcast. Photo courtesy of Station Houston

Houston is just a few months away from being able to walk into The Ion, and the organization's director of partnerships, Deanea LeFlore, hopes that when that happens, they are entering a innovation hub reflective of the city.

"I think that when people walk into The Ion, what's personally important to me, is that it looks like Houston so that you see yourself reflected in the people in the building as well as the programming," LeFlore says. "That's my biggest hope and aspiration, and I believe we are well on track to be able to deliver on exactly that."

LeFlore shares more on what she's been working on — from online programming to growing partnerships at The Ion. Listen to the podcast and read more.

Dr. Mehdi Razavi, director of Electrophysiology Clinical Research & Innovations at the Texas Heart Institute

A medical device coming out of the Texas Heart Institute has been recognized for its innovation. Photo via THI

A new technology out of Houston's Texas Heart Institute's was named the top future medical product design worldwide last month as part of the annual Create the Future Design contest. The med device, which allows for pain-free defibrillation, is being developed by THI's Electrophysiology Clinical Research & Innovations team in conjunction with scientists at Rice University and UCLA, the technology allows doctors to place up to 12 tiny nodes around the heart to pace and defibrillate the heart without using a shock.

The technology will be most useful for atrial fibrillation and ventricular fibrillation, which can lead to sudden death, stroke, and congestive heart failure, according to Dr. Mehdi Razavi, the head investigator on this project and leader of the THI team.

"It's extremely painful. It's like someone takes a two by four and just pounds you from the inside in the chest, or a horse kicking you in the chest," Razavi says. He went on to add: "I have actually one patient who was a Vietnam veteran. He said nothing that he faced in battle was as disconcerting—not just because of the pain, but the fact that you don't know when the pain is when the shock is about to happen. That anxiety is just overwhelming." Read more.