Exclusive: Plug and Play announces 15 energy tech companies for inaugural Houston cohort

onboarding

A Silicon Valley accelerator program has announced the companies that will participate in its first Houston cohort just as the program begins to foster energy tech innovation in town.

Plug and Play Technology Center, which announced its entry into the Houston market this summer, named the 15 companies that will complete the program. While there are only two Houston-based companies in the mix this time around, all 15 companies will be operating locally with Houston corporate partners and startup development organizations.

"By being a part of this Plug and Play cohort, our corporate partners have validated that there is an interest in these startups' technology solutions," says Payal Patel, director of corporate partnerships for Plug and Play in Houston. "This will encourage these non-Houston based startups to spend more time in Houston, likely (and hopefully) leading to them doing business with our corporations, raising money from local investors, hiring local talent, and setting up an office in Houston."

Patel says the selection process was similar to the due diligence done in investor research, since Plug and Play treats its startups like a portfolio of sorts. Plug and Play hosted a pitch night in September as a way to introduce the cohort finalists to the ecosystem before making the final selection.

"We used the technology focus areas of our corporate partners to source 100 startups with commercial viability in Houston," Patel says. "Through consultation with our partners and voting at our Selection Day event in September, we ultimately narrowed the group to 15 startups we believe we can provide value to over the next few months."

The startups are off to Plug and Play's headquarters in California for a Focus Week, Patel says, then will return to Houston for various corporat events, converences, and more as part of the program.

Here are the 15 companies that will participate in the energy and sustainability accelerator from Plug and Play Tech Center.

Alchera Inc.

Founded: 2016

Money raised: $6 million

Employees: 45 full time, 60 part time

Headquarters: South Korea

About: Alchera's technology uses artificial intelligence image to prevent the loss of lives and money in dangerous situations on site.

Ario Technologies Inc.

Founded: 2016

Money raised: $2.3 million

Employees: 8 full time, 1 part time

Headquarters: Norfolk, Virginia

About: Ario has a augmented reality technology that allows its users to search its data in the real world.

Blacksands Inc.

Founded: 2012

Money raised: $1 million

Employees: 5 full time, 7 part time

Headquarters: Sunnyvale, California

About: Blacksands has a secured connection as a service business model for fast-paced cybersecurity.

BlastPoint

Founded: 2016

Money raised: $1.3 million

Employees: 7 full time, 3 part time

Headquarters: Pittsburgh, Pennsylvania

About: Using internal insights and data, BlastPoint helps make innovative ideas a reality in the workplace.

ForePaas

Founded: 2015

Money raised: $10 million

Employees: 40 full time, 1 part time

Headquarters:

About: The ForePaas platform combines cloud-based technology and data applications to optimize and accelerate industrial internal enterprise data initiatives.

Capella Space

Founded: 2016

Money raised: $50 million

Employees: 50 full time, 0 part time

Headquarters: San Francisco

About: Capella Space is building a large commercial radar satellite constellation to speed up the informed decision making process for industrial workers down on earth.

Cumulus Digital Solutions

Founded: 2018

Money raised: $4.5 million

Employees: 14 full time, 4 part time

Headquarters: Cambridge, Massachusetts

About: Using data collection and cloud-based software, Cumulus is eliminating poor work quality that causes accidents in the field.

Data Gumbo

Founded: 2016

Money raised: $3.2 million

Employees: 19 full time, 4 part time

Headquarters: Houston

About: Data Gumbo has developed a blockchain network for automated contract execution for industrial clients

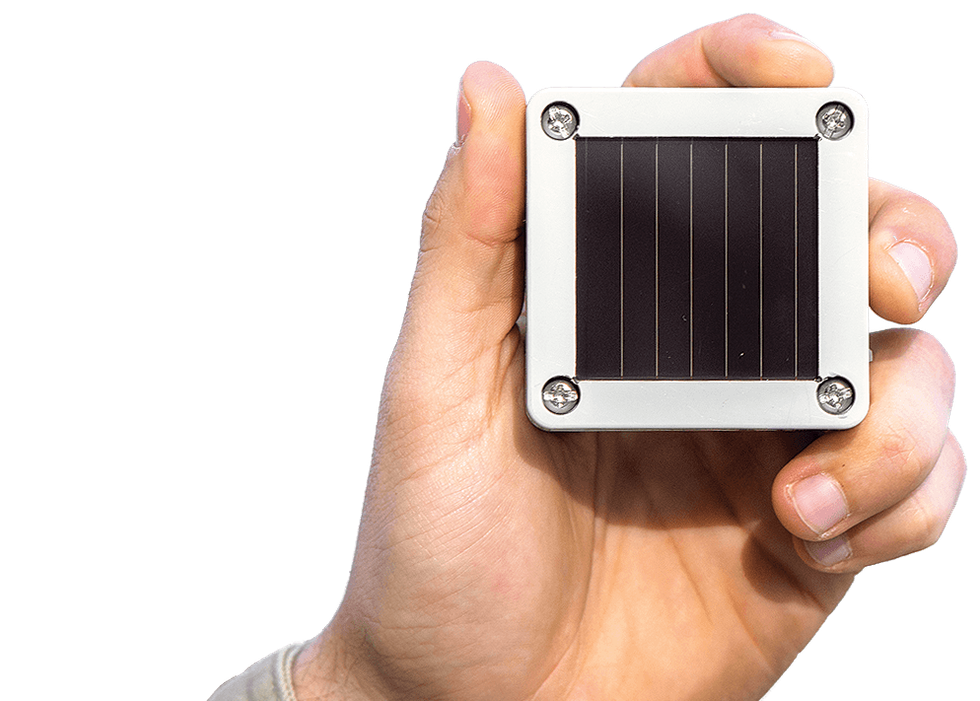

Latium Technologies

Founded: 2019

Money raised: $1 million (Canadian)

Employees: 8 full time, 0 part time

Headquarters: Edmonton, Canada

About: Latium has developed a better industrial IoT platform for heavy industry.

Indegy

Founded: 2014

Money raised: $18 million

Employees: 53 full-time, 0 part-time

Headquarters: New York

About: Indegy specializes in real-time security for industrial campuses.

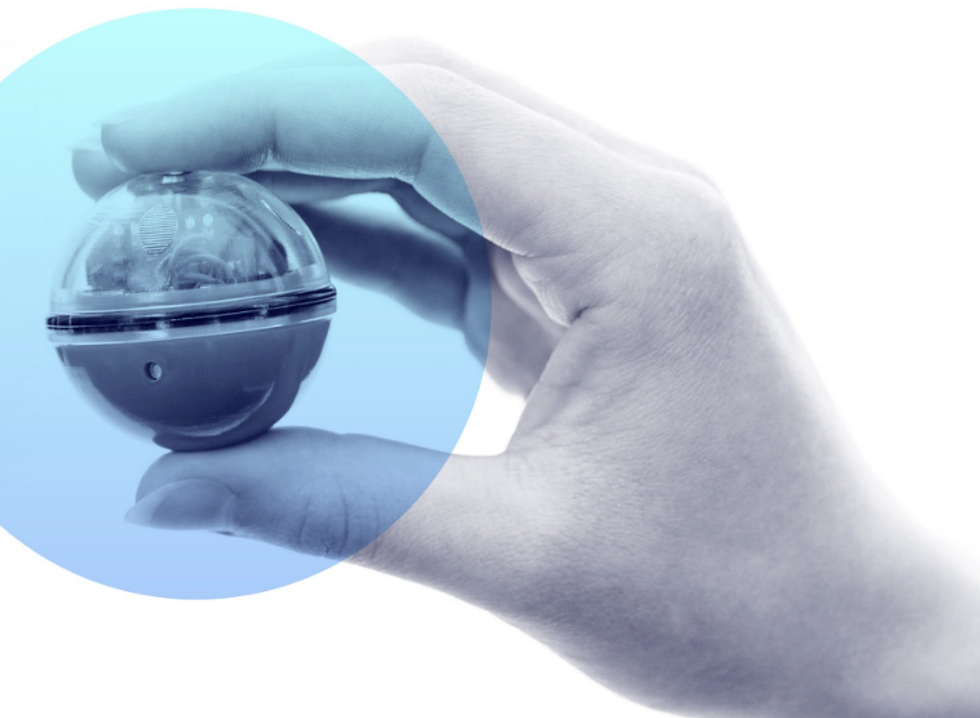

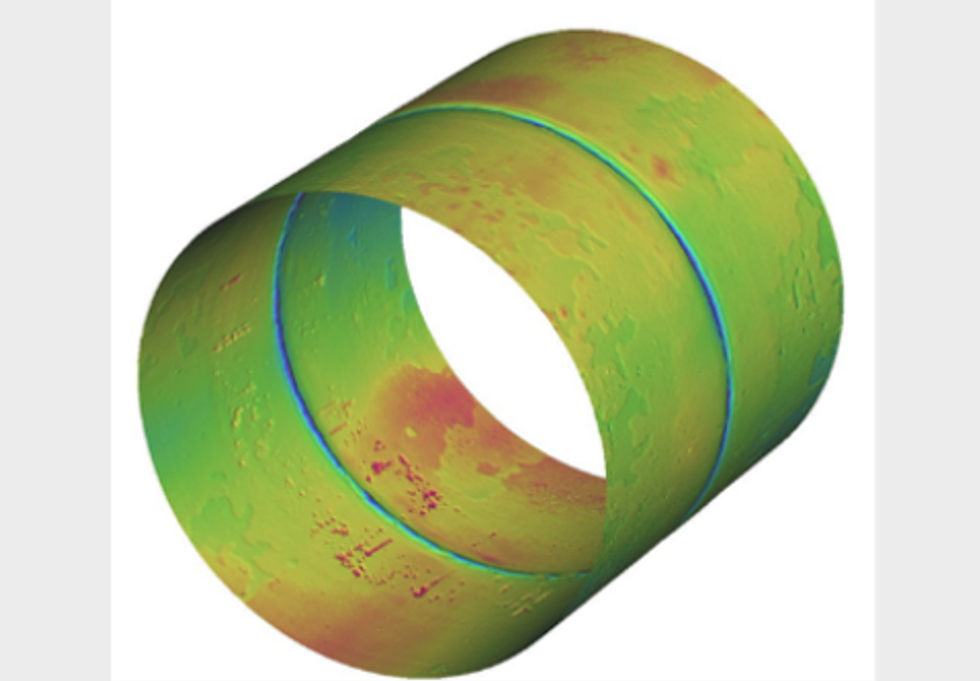

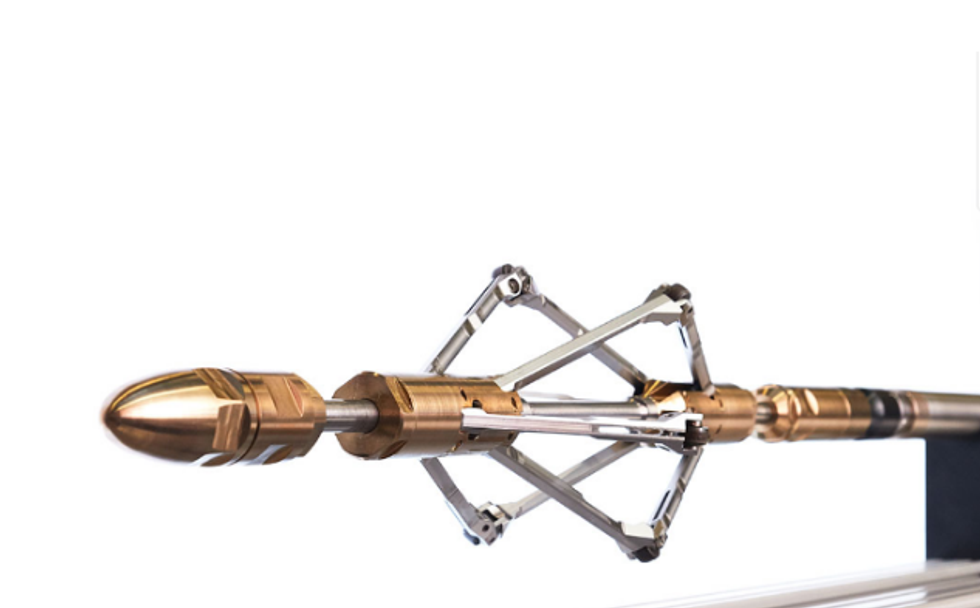

Ingu Solutions

Founded: 2014

Money raised: $2.1 million (Canadian)

Employees: 10 full-time, 0 part-time

Headquarters: Calgary, Canada

About: Ingu wants to revolutionize the economics of the pipeline industry with new technology and initiatives.

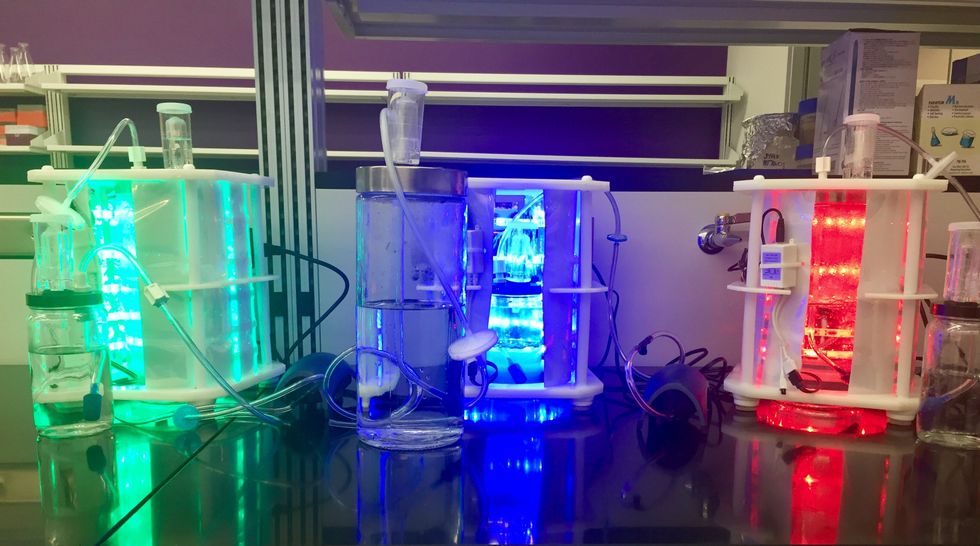

Cemvita Factory

Founded: 2017

Money raised: None disclosed.

Employees: 8 full time, 10 part time

Headquarters: Houston

About: Cemvita has patented technology that can mimic photosynthesis to lower carbon emissions.

KX

Founded: 1999

Money raised: None disclosed.

Employees: 2,500 full-time and 0 part-time

Headquarters: Northern Ireland

About: KX is a data company that uses its global technology in the finance, retail, pharma, manufacturing, and energy industries.

Ondaka Inc.

Founded: 2017

Money raised: $1.6 million

Employees: 8 full time, 2 part time

Headquarters: Palo Alto, California (has a local office at Station Houston)

About: Ondaka uses an alphabet soup of buzzword technologies — IoT, AI, VR — and allows oil and gas companies to really visualize their infrastructure.

Terrapin

Founded: 2016

Money raised: $3 million

Employees: 10 full time, 5 part time

Headquarters: Edmonton, Canada

About: Terrapin is a designer and developer of industrial heat recovery projects.