Looking back: Top 5 most-read Houston sports tech stories of 2024

year in review

Editor's note: As the year comes to a close, InnovationMap is looking back at the year's top stories in Houston innovation. Houston is a city primed for sports tech innovation — with its collection of major sports teams, vibrant population, and tech workforce. Here are five sports tech news stories that stood out to readers this year — be sure to click through to read the full story.

10 sports tech startups named to Houston-based hybrid accelerator

Introducing the 10 startups participating in the Spring 2024 cohort of the DivInc Sports Tech Accelerator, a hybrid program based in the Ion. Photo via DivInc.com

DivInc has named its latest sports tech-focused cohort of its hybrid accelerator that is housed out of the Ion.

The Sports Tech Accelerator has selected the 10 companies — with technology across human performance, fan experience, and more — for its 13th cohort to participate in the 12-week hybrid program this month and through July.

The program receives support from underdog venture team, Women In Sports Tech, The Collectiv, and HTX Sports Tech, with partners Bank of America, J.P. Morgan Chase & Co., Gunderson Dettmer, Brown Advisory, Ion, and Mercury. Continue reading.

High-tech virtual racing experience to rev up in Houston

Houston is getting 16 racing simulators, each equipped with full motion systems and immersive, 180-degree panoramic displays. Photo by Dylan McEwan

Come next year, some high-speed and high-tech race simulators will be added to one of Houston's growing districts.

Velocity - Sim Racing Lounge, described in press materials as Houston’s first premium simulation racing experience, is slated to open in early 2025 at 2110 Edwards St.Velocity will bring sim racing to Houston through 16 racing simulators, each equipped with full motion systems and immersive, 180-degree panoramic displays. The goal is provide customers with a truly authentic, virtual driving experience.

Customers will have the ability to virtually drive sports cars from iconic brands like Porsche and Lamborghini and race on world famous tracks, including the Circuit of the Americas, Laguna Seca, and the Silverstone Circuit. Classic roads, such as California’s Pacific Coast Highway, provide a more leisurely alternative to driving flat out. Continue reading.

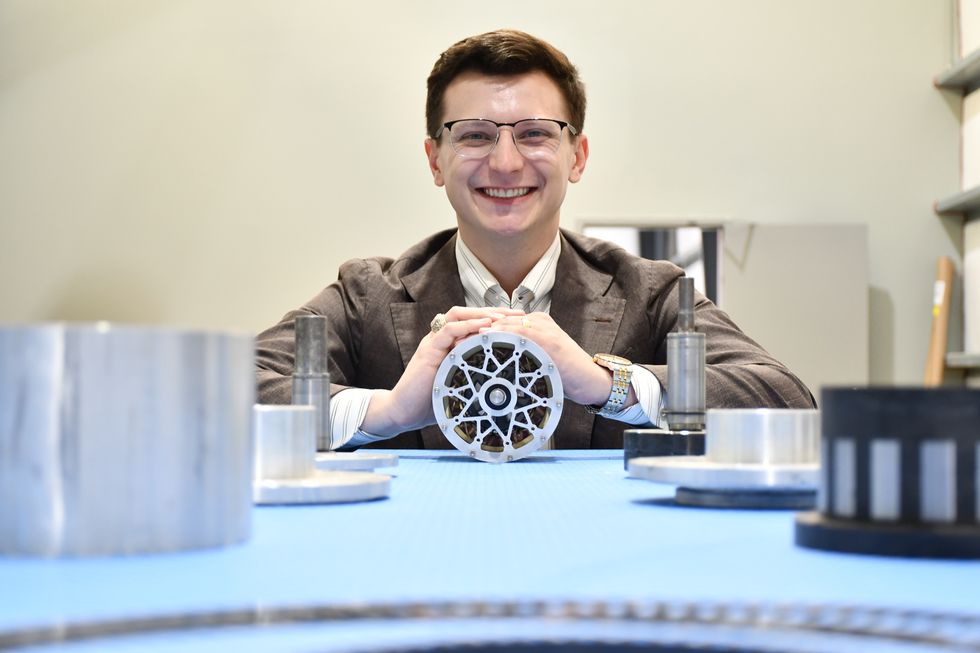

Rice University announces partnership with Houston sports tech startup to enhance student athletics

Rice University's athletic programs will be supported by Houston startup BeOne Sports' technology. Photo courtesy of Rice University

Rice University — in an effort to enhance athletics and research-driven innovation — has formed a partnership with a startup founded by its alumni.

BeOne Sports, a sports performance technology company developed a platform for mobile motion-capture AI and advanced data analytics, will integrate its technology within Rice's sports medicine and rehabilitation programs.

“This partnership aligns perfectly with Rice University’s mission to harness innovation for the betterment of our community,” Rice President Reginald DesRoches says in a news release. “By integrating cutting-edge technology from BeOne Sports with our already world-class athletic and academic programs, we are providing our student athletes with the tools they need to excel both on the field and in life. This collaboration is a testament to Rice’s commitment to leading through innovation and offering unparalleled opportunities for our students.” Continue reading.

Diversity-focused sports tech accelerator opens applications to Houston innovators for the first time

Calling all sports tech startups founded by Black or Hispanic innovators. Photo via Getty Images

A global organization has announced it's opening applications to its equity-focused sports tech accelerator to Houston founders for the first time.

Thanks to a collaboration with Impact Hub and Black Ambition, the adidas Community Lab has expanded its footprint and is now accepting applicants from new markets, including Houston, Toronto, Los Angeles, Atlanta, and New York, for its 2024-2025 cohort.

The initiative, which has been running for three years, has a goal of supporting Black and Latino/a/e founders with mentorship, pitch training, event programming, and networking. The eight-month program also has $75,000 in grant funding to dole out to participants as well. Continue reading.

Houston sports tech startup aims to optimize unsold resale ticket market with new platform

Looking to score the best deal on your next game ticket? A new Houston-founded app promises to revolutionize the resale market. Photo via Getty Images

Online platforms have long simplified the process of buying, selling, and trading event tickets. But what happens when your tickets don’t sell or when you’re stuck with costly season tickets you can’t use? You might end up giving them away or leaving them unused, leading to a financial loss either way.

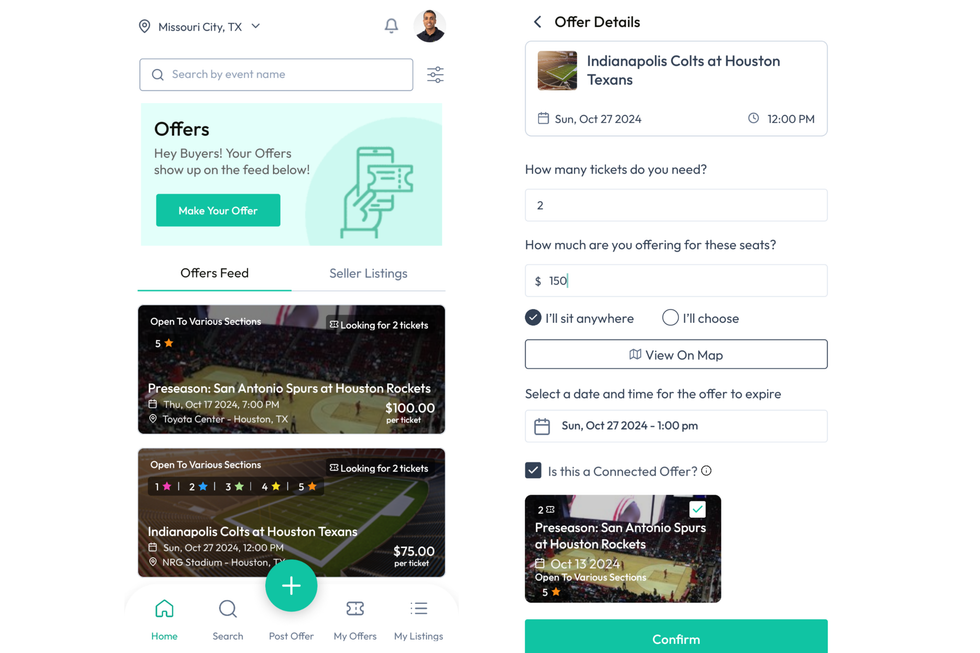

This is the challenge that Houstonian Jerin Varkey is willing to address with Offer Approved, a new platform that empowers sellers and buyers, guaranteeing that no seat goes unused.

The idea took root around two years ago when Varkey, a passionate sports fan and season ticket holder, faced a new challenge. After becoming a parent, he found himself unable to attend every game. Frustrated with traditional resale platforms, he quickly realized that high fees and limited time made it difficult to sell all his tickets, causing him to lose money each time. Continue reading.

- Houston startups raise funding, secure partnerships across space, health, and sports tech ›

- 10 sports tech startups named to Houston-based hybrid accelerator ›

- Houston university awards grant to Texas accelerator to support sports tech ›

- Houston entrepreneur launches $100M SPAC, plans to target sports tech ›

- Rice University announces partnership with Houston sports tech startup to enhance student athletics ›

- Diversity-focused sports tech accelerator opens applications to Houston innovators for the first time ›

Offer Approved is a transparent and trusted platform for both sellers and buyers. Screenshots courtesy of Offer Approved

Offer Approved is a transparent and trusted platform for both sellers and buyers. Screenshots courtesy of Offer Approved Jerin Varkey founded Offer Approved to target unsold resale tickets to sporting events. Photo courtesy of Offer Approved

Jerin Varkey founded Offer Approved to target unsold resale tickets to sporting events. Photo courtesy of Offer Approved

Apple doubles down on Houston with new production facility, training centerPhoto courtesy Apple.

Apple doubles down on Houston with new production facility, training centerPhoto courtesy Apple.