Houston hailed as one of America's 10 best cities for startups

Startup Report

Houston's favorable economic climate is enticing new opportunities for entrepreneurship and growth, and now the city is being hailed as the 7th-best U.S. city for starting a business.

The recognition comes in CommercialCafe's recent "Best Cities for Startups" report, published December 10. The study analyzed large U.S. cities across two population categories – cities with more than 1 million residents and cities with populations between 500,000 and 1 million residents. The report analyzed relevant metrics such as office or coworking costs, Kickstarter funding success, startup density, and survival rates, among others.

Across the biggest U.S. cities with over a million residents, Phoenix, Arizona landed on top as the No. 1 best place to start a new business.

The report's findings revealed 10.6 percent of all businesses in Houston are startups that have been active for less than a year. These new businesses have a survival rate of 64.5 percent, meaning just under two-thirds of all startups in the city will still be running up to five years after they were first established.

Over the last five years, the number of new businesses established in Houston has grown nearly 15 percent. CommercialCafe said new businesses in cities with high startup growth rates tend to "attract top talent" which can eventually lead to securing "vital funding for expansion."

Independent professionals – also known as freelancers – are another crucial resource for new businesses that may need "specialized services" for a fixed amount of time, the report said. Houston's freelance workforce has grown about 9 percent from 2019-2023, and the analysis found there were 97,295 freelancers working in Houston in 2023, compared to 89,528 in 2019.

"Generally, cities in the South and Southwest have experienced strong growth during the surveyed period, in contrast to California cities like Los Angeles and San Diego, where the share of freelancers and gig workers has either stagnated or slightly declined," the report said.

Houston boasts the second-cheapest office space rent nationally, the report found. The average asking price for a 1,000-square-foot workspace (for five employees) in the city added up to $27,124 annually. For startups that want greater flexibility for their workers, the annual cost for a coworking space for the same number of employees in Houston came out to $13,200, which is the fourth-most affordable rate in the U.S.

Other Texas cities with attractive economic environments for startups

Texas, as a whole, is one of the strongest states for starting a new business. Other than Houston, San Antonio (No. 2), Dallas (No. 3), and Fort Worth (No. 4) were also recognized among the top 10 best places to start a business in the category of U.S. cities with more than a million residents.

Austin topped a separate ranking of best cities to start a business with 500,000 to 1 million residents.

"Specifically, the Texas capital was the frontrunner for indicators that looked at the overall share of startups within the local economy, as well as growth rates in five years (2019 to 2023)," the report said. "On top of that, Austin also topped the rankings for its percentage of college-educated residents and its consulting firms, which provide vital support for burgeoning enterprises."

The top 10 best cities to start a new business are:

- No. 1 – Phoenix, Arizona

- No. 2 – San Antonio, Texas

- No. 3 – Dallas, Texas

- No. 4 – Fort Worth, Texas

- No. 5 – Jacksonville, Florida

- No. 6 – San Diego, California

- No. 7 – Houston, Texas

- No. 8 – Philadelphia, Pennsylvania

- No. 9 – Chicago, Illinois

- No. 10 – Los Angeles, California

This article originally appeared on CultureMap.com.

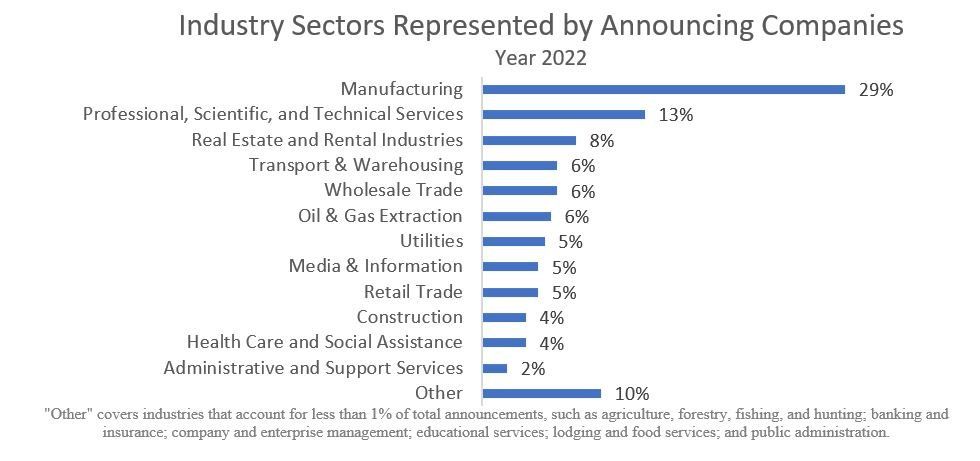

Chart via houston.org

Chart via houston.org