Houston researchers develop new battery prototype to impact wearable technology

flexible innovation

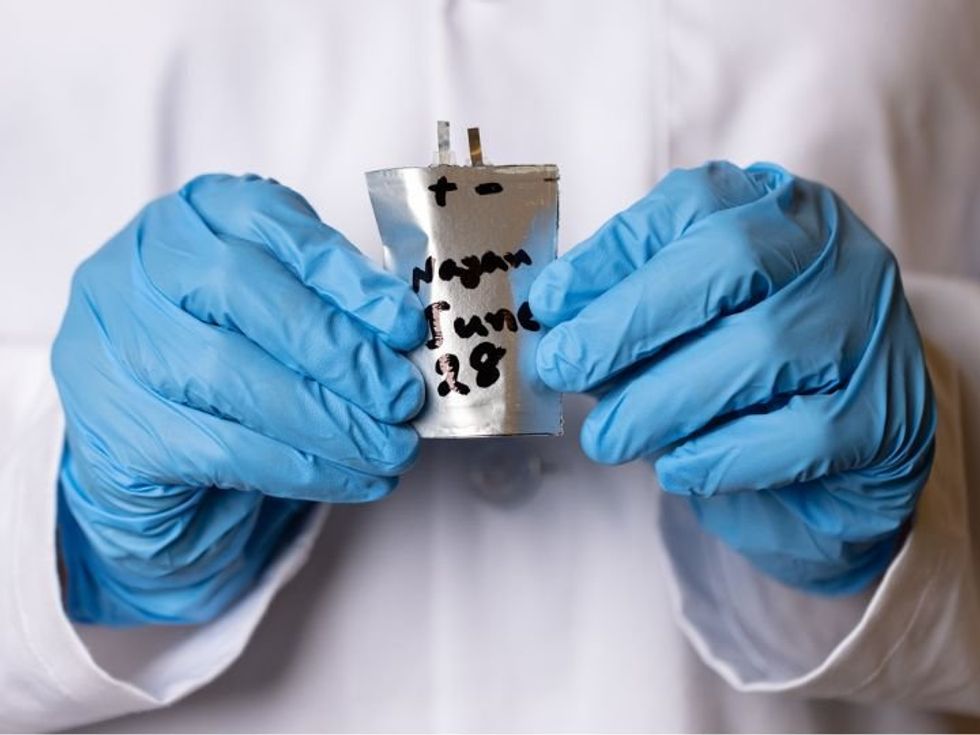

A new breakthrough prototype out of the University of Houston was inspired by science fiction.

"As a big science fiction fan, I could envision a ‘science-fiction-esque future’ where our clothes are smart, interactive and powered,” according to a statement Haleh Ardebili, who last month published a paper on a new stretchable fabric-based lithium-ion battery in the Extreme Mechanics Letters.

“It seemed a natural next step to create and integrate stretchable batteries with stretchable devices and clothing," she said. "Imagine folding or bending or stretching your laptop or phone in your pocket. Or using interactive sensors embedded in our clothes that monitor our health.”

The battery uses conductive silver fabric as a platform and current collector, which stretches (or mechanically deforms) while allowing movement for electrons and ions. Traditional lithium batteries are quite rigid and use a liquid electrolyte, which are flammable and have potential risks of exploding.

The technology is only a prototype now, but Ardebili, who's the Bill D. Cook Professor of Mechanical Engineering at UH, and the paper's first author Bahar Moradi Ghadi, a former doctoral student, think the battery could have many applications, including in smart space suits, consumer electronics and implantable biosensors.

The team's focus now is to ensure the battery is "as safe as possible" before it becomes available on the market.

“Commercial viability depends on many factors such as scaling up the manufacturability of the product, cost and other factors,” Ardebili said. “We are working toward those considerations and goals as we optimize and enhance our stretchable battery.”

Ardebili first conceptualized the product several years ago and has since earned several key wards and grants to support the design, including a five-year National Science Foundation CAREER Award in 2013, a New Investigator Award from the NASA Texas Space Center Grant Consortium in 2014 and an award from the US Army Research Lab in 2017.

A number of Houston-based organizations are working to create innovative batteries.

Earlier this summer, TexPower EV Technologies Inc. opened a 6,000-square-foot laboratory and three-ton-per-year pilot production line in Northwest Houston to help the University of Texas-born company to further commercialize its cobalt-free lithium-ion cathode, which can be used in electric vehicles.

Another Houston-based company Zeta Energy has also developed proprietary sulfur-based cathodes and lithium metal anodes that have shown to have higher capacity and density and better safety profiles than lithium sulfur batteries. The company landed a $4 million grant from the U.S. Department of Energy's ARPA-E Electric Vehicles for American Low-Carbon Living, or EVs4ALL, program, in January.