Innovative Houston research leads our top health tech news of 2025

year in review

Editor's note: As 2025 comes to a close, we're looking back at the stories that defined Houston innovation this year. The Bayou City continued to grow as a health tech hub, bringing in a multibillion-dollar pharmaceutical development, playing home based to startups developing innovative treatment options and attracting leading researchers and professionals to the city. Here are the 10 most-read Houston health tech stories of the year:

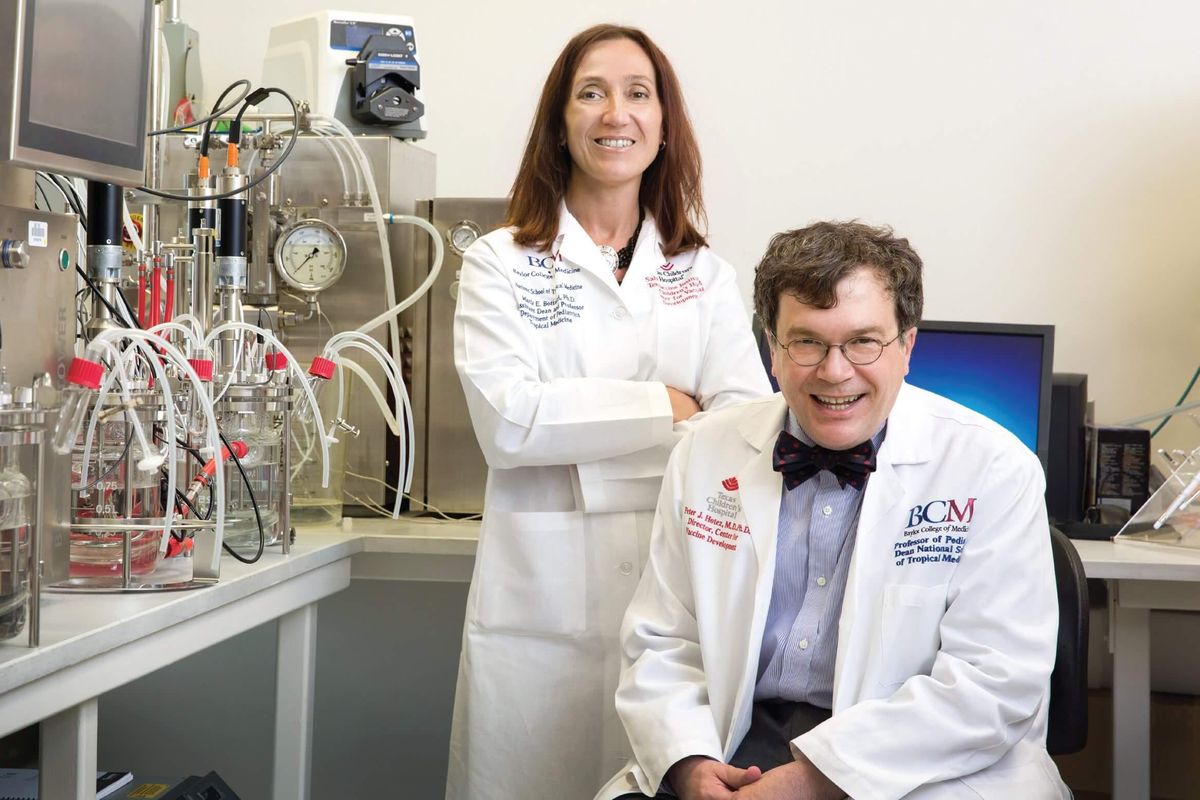

Houston Nobel Prize nominee earns latest award for public health research

Dr. Peter Hotez with Dr. Maria Elena Bottazzi. Photo courtesy of TMC

Houston vaccine scientist Dr. Peter Hotez is no stranger to impressive laurels. In 2022, he was nominated for a Nobel Peace Prize for his low-cost COVID vaccine.

His first big win of 2025 was this year’s Hill Prize, awarded by the Texas Academy of Medicine, Engineering, Science and Technology (TAMEST). Hotez and his team were selected to receive $500,000 from Lyda Hill Philanthropies to help fund The Texas Virosphere Project, which aims to create a predictive disease atlas relating to climate disasters. Rice University researchers are collaborating with Hotez and his team on a project that combines climate science and metagenomics to access 3,000 insect genomes. The goal is to aid health departments in controlling disease and informing policy. Continue reading.

U.S. News ranks Houston hospital No. 1 in Texas for 14th year in a row

Houston Methodist is once again the top hospital in Texas. Photo via Houston Methodist

U.S. News & World Report's 2025 rankings of the best hospitals in Texas prove that Houston is in good hands.

The esteemed Houston Methodist Hospital was rated the No. 1 best hospital in Texas for the 14th consecutive year, and the No. 1 hospital in the metro area. Eleven more Houston-area hospitals earned spots among the statewide top 35. Continue reading.

Eli Lilly to build $6.5B pharmaceutical factory at Generation Park

Eli Lilly is expected to bring a $6.5 billion manufacturing facility to Houston by 2030. Rendering courtesy Greater Houston Partnership.

Pharmaceutical giant Eli Lilly and Co. plans to build a $6.5 billion manufacturing plant at Houston’s Generation Park. More than 300 locations in the U.S. competed for the factory.

The Houston site will be the first major pharmaceutical manufacturing plant in Texas, according to the Greater Houston Partnership. Lilly said it plans to hire 615 full-time workers for the 236-acre plant, including engineers, scientists and lab technicians. The company will collaborate with local colleges and universities to help build its talent pipeline. Continue reading.

How a Houston company is fighting anxiety, insomnia & Alzheimer’s through waveforms

Nexalin develops non-invasive devices that help reset networks in the brain associated with symptoms of anxiety and insomnia. Photo via Getty Images.

Houston-based Nexalin Technology is taking a medicine-free approach to target brain neurologically associated with mental illness. The company's patented, FDA-cleared frequency-based waveform targets key centers of the midbrain. Delivered via a non-invasive device, the treatment gently stimulates the hypothalamus and midbrain, helping to “reset networks associated with symptoms” of anxiety and insomnia.

Nexalin’s proprietary neurostimulation device moved forward with a clinical trial that evaluated its treatment of anxiety disorders and chronic insomnia in Brazil this year and enrolled the first patients in its clinical trial at the University of California, San Diego. Continue reading.

Houston doctor aims to revolutionize hearing aid industry with tiny implant

Houston Methodist's Dr. Ron Moses has created NanoEar, which he calls “the world’s smallest hearing aid.” Photo via Getty Images.

“What is the future of hearing aids?” That’s the question that led to a potential revolution.

Dr. Ron Moses, an ENT specialist and surgeon at Houston Methodist, is the creator of NanoEar, which he calls “the world’s smallest hearing aid.” NanoEar is an implantable device that combines the invisibility of a micro-sized tympanostomy tube with more power—and a superior hearing experience—than the best behind-the-ear hearing aid. Continue reading.

Houston scores $120M in new cancer research and prevention grants

The Cancer Prevention and Research Institute of Texas doled out 73 more grants to health care systems and companies in the state in November. Carter Smith/Courtesy of MD Anderson

The Cancer Prevention and Research Institute of Texas granted more than $120 million to Houston organizations and companies as part of 73 new awards issued statewide this fall. The funds are part of nearly $154 million approved by the CPRIT's governing board, bringing the organization's total investment in cancer prevention and research to more than $4 billion since its inception. A portion of the funding will go toward recruiting leading cancer researchers to Houston. Continue reading.

Digital Health Institute's new exec director aims to lead innovation and commercialization efforts

Pothik Chatterjee was named executive director of Rice University's and Houston Methodist's Digital Health Institute, effective May 1. Photo courtesy Rice University.

The Digital Health Institute, a joint venture between Rice University and Houston Methodist, appointed Pothik Chatterjee to the role of executive director this summer. Chatterjee’s role is to help grow the collaboration between the institutions, but the Digital Health Institute already boasts more than 20 active projects, each of which pairs Rice faculty and Houston Methodist clinicians. Once the research is in place, it’s up to Chatterjee to find commercial opportunities within the research portfolio. Those include everything from hospital-grade medical imaging wearables to the creation of digital twins for patients to help better treat them. Continue reading.

Innovation Labs @ TMC set to launch for early-stage life science startups

Innovation Labs @ TMC will open next year at the TMC Innovation Factory. Photo courtesy JLABS.

The Texas Medical Center announced its plans to launch its new Innovation Labs @ TMC in January 2026 to better support life science startups working within the innovation hub. The 34,000-square-foot space, located in the TMC Innovation Factory at 2450 Holcombe Blvd., will feature labs and life science offices and will be managed by TMC. The expansion will allow TMC to "open its doors to a wider range of life science visionaries." Continue reading.

6 Houston health tech startups making major advancements right now

Tatiana Fofanova and Dr. Desh Mohan, founders of Koda Health. Photo courtesy Koda Health.

The Health Tech Business category in our 2025 Houston Innovation Awards honored innovative startups within the health and medical technology sectors. Six forward-thinking businesses were named finalists for the 2025 award, ranging from an end-of-life care company to others developing devices and systems for heart monitoring, sleep apnea, hearing loss and more. Continue reading or see who won here.

Houston students develop cost-effective glove to treat Parkinson's symptoms

Rice University students Emmie Casey and Tomi Kuye used smartphone motors to develop a vibrotactile glove. Photo by Gustavo Raskosky/ Courtesy Rice University.

Two Rice undergraduate engineering students have developed a non-invasive vibrotactile glove that aims to alleviate the symptoms of Parkinson’s disease through therapeutic vibrations. Emmie Casey and Tomi Kuye developed the project with support from the Oshman Engineering Design Kitchen (OEDK). The team based the design on research from the Peter Tass Lab at Stanford University, which explored how randomized vibratory stimuli delivered to the fingertips could help rewire misfiring neurons in the brain—a key component of Parkinson’s disease. Continue reading.