Photos: Houston innovation leaders weigh in on cybersecurity, tech, and more at inaugural event

total knock out

What do you get when you cross the information of an innovation panel with the ferocity of a boxing match? A verbal sprawling among innovation leaders that can only be known as the Digital Fight Club.

Houston's DFC came about with the help of Accenture, which had been a partner at the Dallas events, and InnovationMap, who teamed up as presenting sponsors for the event. DFC's founder, Michael Pratt, came up with the idea for Digital Fight Club as a way to liven up technology-focused events and networking opportunities.

The setup of the event is five fights, 10 fighters, and five judges. Each fighter has just a couple minutes to take their stand before the event moves on.

"This is Digital Fight Club," says Pratt, CEO of the company. "You get subject matter experts, and serious founders and CEOs on the stage and make them make their case. You learn something, it's a lot of fun, and it's a lot better than a panel."

The hour of fighting is coupled with a VIP event ahead of the showdown and an after party where further networking can continue on. At Houston's VIP event, InnovationMap got to check in with partners, fighters, and referees about how they thought the event was going to pan out. Check out the VIP event video here.

The panel of referees included Gabriella Rowe, CEO of Station Houston; Denise Hamilton, CEO of Watch Her Work; Tim Kopra, partner at Blue Bear Capital; Lance Black, Director at TMCx; and Barbara Burger, president of Chevron Technology Ventures.

The refs asked two questions per fight, and were able to vote on the winners of each round — as was the audience through an interactive web-based application. The break down of the fights, topics, and winners are as follows:

Fight #1: Future Workforce of Robotics/AI. Matt Hager, CEO of Poetic Systems, vs Pablo Marin, senior AI Leader, Microsoft. Hager took the win with 77 percent of the vote.

Fight #2: Whose responsibility is cybersecurity. Ted Gutierrez, CEO of SecurityGate vs Tara Khanna, managing director and Security Lead at Accenture. Khanna won this round, snagging 66 percent of the votes.

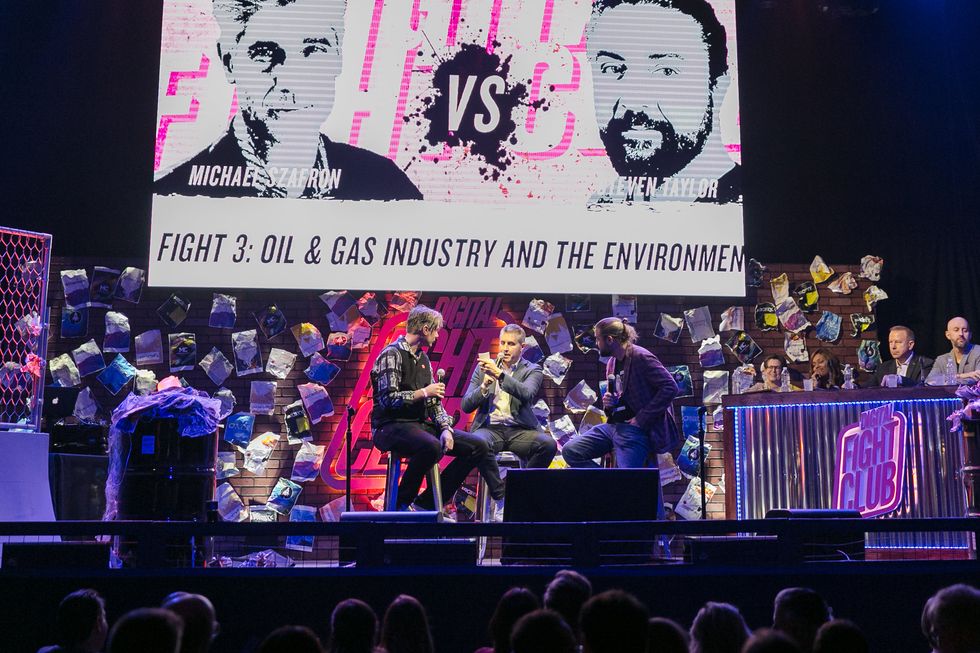

Fight #3: Oil & Gas Industry and the Environment. Michael Szafron - commercial adviser for Cemvita Factory, vs Steven Taylor, co-founder of AR for Everyone. Szafron received 76 percent of the voites, securing the win.

Fight #4: Digital in our personal lives. Grace Rodriguez, CEO of ImpactHub, vs Javier Fadul, chief innovation officer at HTX Labs. Rodriguez won with the largest margin of the night — 85 percent.

Fight #5: Future of Primary Care Geetinder Goyal, CEO of First Primary Care, vs Nick Desai, chief medical information officer at Houston Methodist. Goyal received 72 percent of the votes to take home the win.

The fights were heated, and some of the fighters had knockout quotes, from Hager's "AI is mostly bullshit" to Khanna's "Compliance doesn't mean you're secure." For more of the knockout quotes, click here.