More than a billion people worldwide can’t access credit cards or loans because they lack a traditional credit score. Without a formal borrowing history, banks often view them as unreliable and risky. To reach these borrowers, lenders have begun experimenting with alternative signals of financial reliability, such as consistent utility or mobile phone payments.

New research from Rice Business builds on that approach. Previous work by assistant professor of marketing Jung Youn Lee showed that everyday data like grocery store receipts can help expand access to credit and support upward mobility. Her latest study extends this insight, using broader consumer spending patterns to explore how alternative credit scores could be created for people with no credit history.

Forthcoming in the Journal of Marketing Research, the study finds that when lenders use data from daily purchases — at grocery, pharmacy, and home improvement stores — credit card approval rates rise. The findings give lenders a powerful new tool to connect the unbanked to credit, laying the foundation for long-term financial security and stronger local economies.

Turning Shopping Habits into Credit Data

To test the impact of retail transaction data on credit card approval rates, the researchers partnered with a Peruvian company that owns both retail businesses and a credit card issuer. In Peru, only 22% of people report borrowing money from a formal financial institution or using a mobile money account.

The team combined three sets of data: credit card applications from the company, loyalty card transactions, and individuals’ credit histories from Peru’s financial regulatory authority. The company’s point-of-sale data included the types of items purchased, how customers paid, and whether they bought sale items.

“The key takeaway is that we can create a new kind of credit score for people who lack traditional credit histories, using their retail shopping behavior to expand access to credit,” Lee says.

The final sample included 46,039 credit card applicants who had received a single credit decision, had no delinquent loans, and made at least one purchase between January 2021 and May 2022. Of these, 62% had a credit history and 38% did not.

Using this data, the researchers built an algorithm that generated credit scores based on retail purchases and predicted repayment behavior in the six months following the application. They then simulated credit card approval decisions.

Retail Scores Boost Approvals, Reduce Defaults

The researchers found that using retail purchase data to build credit scores for people without traditional credit histories significantly increased their chances of approval. Certain shopping behaviors — such as seeking out sale items — were linked to greater reliability as borrowers.

For lenders using a fixed credit score threshold, approval rates rose from 15.5% to 47.8%. Lenders basing decisions on a target loan default rate also saw approvals rise, from 15.6% to 31.3%.

“The key takeaway is that we can create a new kind of credit score for people who lack traditional credit histories, using their retail shopping behavior to expand access to credit,” Lee says. “This approach benefits unbanked applicants regardless of a lender’s specific goals — though the size of the benefit may vary.”

Applicants without credit histories who were approved using the retail-based credit score were also more likely to repay their loans, indicating genuine creditworthiness. Among first-time borrowers, the default rate dropped from 4.74% to 3.31% when lenders incorporated retail data into their decisions and kept approval rates constant.

For applicants with existing credit histories, the opposite was true: approval rates fell slightly, from 87.5% to 84.5%, as the new model more effectively screened out high-risk applicants.

Expanding Access, Managing Risk

The study offers clear takeaways for banks and credit card companies. Lenders who want to approve more applications without taking on too much risk can use parts of the researchers’ model to design their own credit scoring tools based on customers’ shopping habits.

Still, Lee says, the process must be transparent. Consumers should know how their spending data might be used and decide for themselves whether the potential benefits outweigh privacy concerns. That means lenders must clearly communicate how data is collected, stored, and protected—and ensure customers can opt in with informed consent.

Banks should also keep a close eye on first-time borrowers to make sure they’re using credit responsibly. “Proactive customer management is crucial,” Lee says. That might mean starting people off with lower credit limits and raising them gradually as they demonstrate good repayment behavior.

This approach can also discourage people from trying to “game the system” by changing their spending patterns temporarily to boost their retail-based credit score. Lenders can design their models to detect that kind of behavior, too.

The Future of Credit

One risk of using retail data is that lenders might unintentionally reject applicants who would have qualified under traditional criteria — say, because of one unusual purchase. Lee says banks can fine-tune their models to minimize those errors.

She also notes that the same approach could eventually be used for other types of loans, such as mortgages or auto loans. Combined with her earlier research showing that grocery purchase data can predict defaults, the findings strengthen the case that shopping behavior can reliably signal creditworthiness.

“If you tend to buy sale items, you’re more likely to be a good borrower. Or if you often buy healthy food, you’re probably more creditworthy,” Lee explains. “This idea can be applied broadly, but models should still be customized for different situations.”

---

This article originally appeared on Rice Business Wisdom. Written by Deborah Lynn Blumberg

Anderson, Lee, and Yang (2025). “Who Benefits from Alternative Data for Credit Scoring? Evidence from Peru,” Journal of Marketing Research.

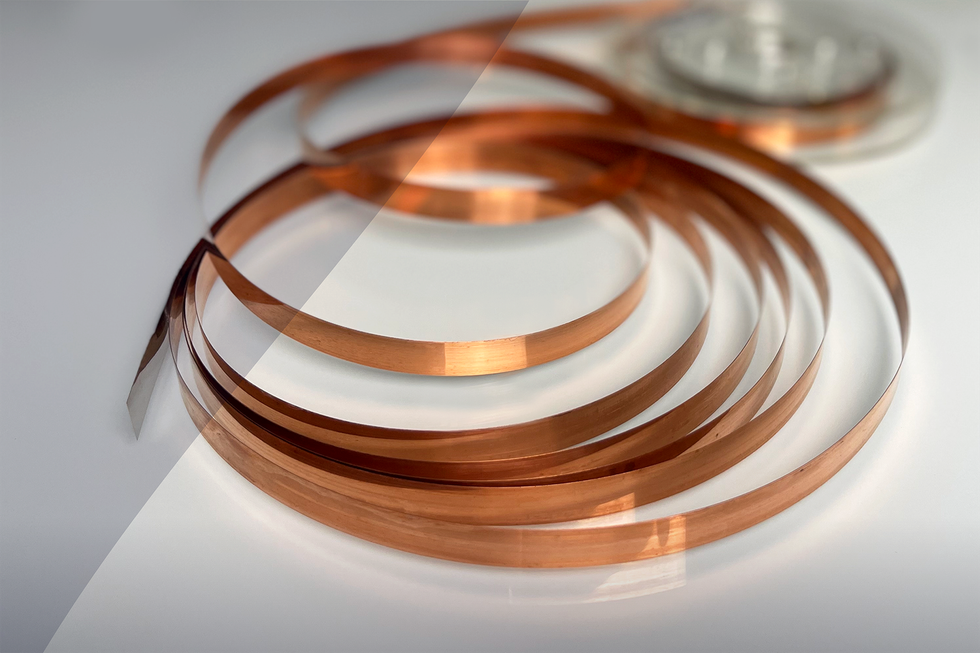

The fresh funding will go toward advancing the company's Xeus HTS wire technology. Photo via metoxtech.com

The fresh funding will go toward advancing the company's Xeus HTS wire technology. Photo via metoxtech.com