Report: Houston ranks in the top 10 life sciences markets in the U.S.

rising star

Houston has received a big thumbs-up in a new study ranking the country’s top metro areas for life sciences companies to launch or grow.

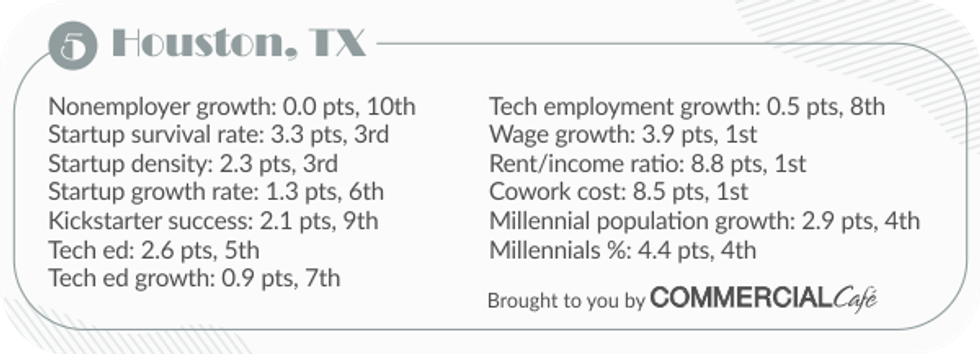

The study, published by commercial real estate platform CommercialCafe, puts Houston at No. 10 among the top U.S. metros in the life sciences sector and No. 1 in Texas. Boston topped CommercialCafe’s ranking, with Dallas-Fort Worth at No. 16, San Antonio at No. 29, and Austin at No. 37.

For the study, CommercialCafe examined various factors that support the success of a life sciences ecosystem. The study encompassed 45 major metros in the U.S. Among the highlights for Houston:

- No. 9 ranking for educational attainment, with 733,577 of residents ages 25 year and older holding at least a bachelor’s degree in science, engineering, or an engineering-related field.

- No. 12 ranking for life sciences projects under development (a little over 817,000 square feet). Overall, the life sciences sector occupies roughly 2.3 million square feet in the Houston area.

Last month, commercial real estate services company CBRE put Houston at No. 13 among the country’s top 25 clusters for life sciences research talent. DFW appeared at No. 16 and Austin at No. 18.

In assessing Houston’s strength in life sciences, CommercialCafe says that “the resilient Texas powerhouse was lifted by the wave of emerging life sciences clusters across the U.S.”

Two major projects are helping Houston maintain that powerhouse status. The Texas Medical Center (TMC) last year unveiled TMC3, a 37-acre, roughly 6 million-square-foot life sciences campus, and Houston-based Hines recently topped out the 270,000-square-foot first phase of the 53-acre Levit Green life sciences district next to TMC.

“Houston is already fortunate to have such a strong healthcare and higher education ecosystem. The TMC3 project stands to be the cornerstone of our regional life sciences strategy. It will create new jobs, [and] advance innovative medical technologies and healthcare solutions,” Houston Mayor Sylvester Turner said in 2021.

According to Greater Houston Partnership data, the Houston area is home to Houston has more than 1,760 life sciences companies, hospitals, health care facilities, and research institutions. Collectively, the life sciences and healthcare sectors employ 320,500 people in the region.