Houston expert: Can Houston replicate and surpass the success of Silicon Valley?

guest column

Anyone who knows me knows, as a Houston Startup Founder, I often muse about the still developing potential for startups in Houston, especially considering the amount of industry here, subject matter expertise, capital, and size.

For example, Houston is No. 2 in the country for Fortune 500 Companies — with 26 Bayou City companies on the list — behind only NYC, which has 47 ranked corporations, according to Fortune.

Considering layoffs, fund closings, and down rounds, things aren’t all that peachy in San Francisco for the first time in a long time, and despite being a Berkeley native, I’m rooting for Houston now that I’m a transplant.

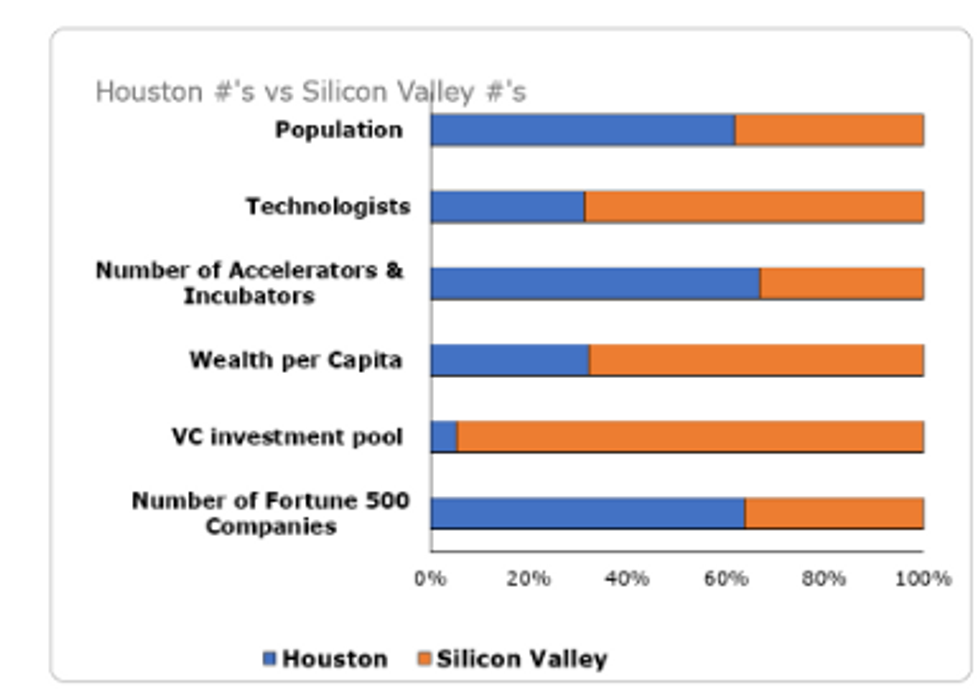

Let’s start by looking at some stats.

While we’re not No. 1 in all areas, I believe we have the building blocks to be a major player in startups, and in tech (and not just energy and space tech). How? If the best predictor of future success is history, why not use the template of the GOAT of all startup cities: San Francisco and YCombinator. Sorry fellow founders – you’ve heard me talk about this repeatedly.

YCombinator is considered the GOAT of Startup Accelerators/Incubators based on:

- The Startup success rate: I’ve heard it’s as high as 75 percent (vs. the national average of 5 to 10 percent) Arc Search says 50 percent of YC Co’s fail within 12 years – not shabby.

- Their startup-to-unicorn ratio: 5 to 7 percent of YC startups become unicorns depending on the source — according to an Arc Search search (if you haven’t tried Arc Search do – super cool).

- Their network.

YC also parlayed that success into a "YC Startup School" offering:

- Free weekly lessons by YC partners — sometimes featuring unicorn alumni

- A document and video Library (YC SAFE, etc)

- Startup perks for students (AWS cloud credits, etc.)

- YC co-founder matching to help founders meet co-founders

Finally, there’s the over $80 billion in returns, according to Arc search, they’ve generated since their 2005 inception with a total of 4,000 companies in their portfolio at over $600 billion in value. So GOAT? Well just for perspective there were a jaw-dropping 18,000 startups in startup school the year I participated – so GOAT indeed.

So how do they do it? Based on anecdotal evidence, their winning formula is said to be the following well-oiled process:

- Bring over 282 startups (the number in last cohort) to San Francisco for 90 days to prototype, refine the product, and land on the go-to-market strategy. This includes a pre-seed YC SAFE investment of a phased $500,000 commitment for a fixed min 7 percent of equity, plus more equity at the next round’s valuation, according to YC.

- Over 50 percent of the latest cohort were idea stage and heavily AI focused.

- Traction day: inter-portfolio traction the company. YC has over 4,000 portfolio companies who can and do sign up for each other’s companies products because “they’re told to."

- Get beta testers and test from YC portfolio companies and YC network.

- If they see the traction scales to a massively scalable business, they lead the seed round and get this: schedule and attend the VC meetings with the founders.

- They create a "fear of missing out" mentality on Sand Hill Road as they casually mention who they’re meeting with next.

- They block competitors in the sector by getting the top VC’s to co-invest with then in the seed so competitors are locked out of the A list VC funding market, who then are up against the most well-funded and buzzed about players in the space.

If what I've seen is true, within a six-month period a startup idea is prototyped, tested, pivoted, launched, tractioned, seeded, and juiced for scale with people who can ‘make’ the company all in their corner, if not already on their board.

So how on earth can Houston best this?

- We have a massive amount of businesses — around 200,000 — and people — an estimated 7.3 million and growing.

- We have capital in search of an identity beyond oil.

- Our Fortune 500 companies that are hiring consultants for things that startups here that can do for free, quicker, and for a fraction of the extended cost.

- We have a growing base of tech talent for potential machine learning and artificial intelligence talent

- A sudden shot at the increasingly laid off big tech engineers.

- We have more accelerators and incubators.

What do we need to pull it off?

- An organized well-oiled YC-like process

- An inter-Houston traction process

- An "Adopt a Startup" program where local companies are willing to beta test and iterate with emerging startup products

- We have more accelerators but the cohorts are small — average five to 10 per cohort.

- Strategic pre-seed funding, possibly with corporate partners (who can make the company by being a client) and who de-risk the investment.

- Companies here to use Houston startup’s products first when they’re launched.

- A forum to match companies’ projects or labs groups etc., to startups who can solve them.

- A process in place to pull all these pieces together in an organized, structured sequence.

There is one thing missing in the list: there has to be an entity or a person who wants to make this happen. Someone who sees all the pieces, and has the desire, energy and clout to make it happen; and we all know this is the hardest part. And so for now, our hopes of besting YC may be up in the air as well.

------

Jo Clark is the founder of Circle.ooo, a Houston-based tech startup that's streamlining events management.